Guinea: Updated Assessment of the Impact of the Coronavirus Pandemic on the Extractive Sector and Resource Governance

This is one of a series of country briefings produced by NRGI to summarize the evolving situation with respect to the pandemic and its economic impacts. The analysis it contains is subject to change with circumstances, and may be updated in due course.

Key messages

- Supported by a dynamic mining sector, the Guinean economy has shown unexpected resilience to the coronavirus pandemic.

- The IMF anticipates that Guinea’s economic growth and debt level will remain stable. However, the government should prepare to respond to companies’ requests for relief and avoid a “race to the bottom.”

- Guinea's government did well in making its resource-backed loan terms more transparent and may consider renegotiating its agreements with Chinese lenders.

- Guinean officials could consider reducing the current substantial spending on mining local development funds at the community level.

- While Guinea’s mining code includes strong transparency and accountability provisions, the pandemic and other resurging health crises may affect civil society actors’ ability to play their oversight role and stall Guinea’s commitments to better sector governance.

Summary of economic impact of the coronavirus pandemic

Supported by a dynamic mining sector, the Guinean economy has shown unexpected resilience to the coronavirus pandemic. But, while mining exports continued to rise during the pandemic as during the past five years, government and company revenues have not reflected this growth as bauxite prices have been deteriorating. In addition, the non-mining sector has been significantly affected by the pandemic and the ensuing restrictions on movement. The International Monetary Fund (IMF)’s fifth and sixth reviews of Guinea, issued in December 2020, estimated that the real Gross Domestic Product (GDP) growth would reach 5.2 percent in 2020 (versus the 2.9 percent projected in April 2020), but non-mining activity would only grow by 2.4 percent, about half of the pre-pandemic projection. The IMF anticipates a real GDP recovery of 5.5 percent in 2021 and 5.2 percent in 2022 thanks to the mining production ramp-up.

The government’s coronavirus response plan, worth USD 275 million (1.8 percent of GDP), was supported by the Guinean Central Bank (BCRG), the World Bank, the African Development Bank, the European Union, and the IMF. Since 2017, the country has been under a three-year USD 170 million IMF extended credit facility (ECF). This has fostered sustainable management of public finance, especially debt. On 9 December 2020 Guinea received the last instalment of USD 49 million under this facility. The government has committed to step up the implementation of its revenue mobilization strategy, including the full application of the mining code, to ensure that Guinea can duly benefit from its mineral resource wealth. At the time of writing, there is no plan to renew the ECF. Guinea also received USD 22.3 million support from the IMF’s Catastrophe Containment and Relief Trust in April 2020, and the IMF board approved a USD 148 million rapid credit facility in July 2020 to address the urgent balance of payment and fiscal financing needs stemming from the coronavirus pandemic. This includes scaling-up health spending, protecting the most vulnerable from the impact of the crisis, and supporting the private sector.

The IMF estimates that the public debt will reach 43.2 percent of GDP in 2021 and will stabilize at 40.4 percent by 2025. A significant reduction in Guinea’s mining revenues would affect this prediction, however. Overall, Guinea relies on concessional borrowing with little capacity for further debt (the IMF and World Bank recommend not to exceed the current public debt-to-GDP ratio). The central bank’s foreign exchange reserves are limited (three to four months of imports), highlighting vulnerability to any significant decline in exports (based on Extractive Industries Transparency Initiative (EITI) data, mining accounts for 79 percent of exports). The ministers with direct connection to the mining sector (mines and geology, budget, territorial administration and decentralization, economy and finance) have not changed after the government reshuffle of January 2021.

Impact on the mining sector

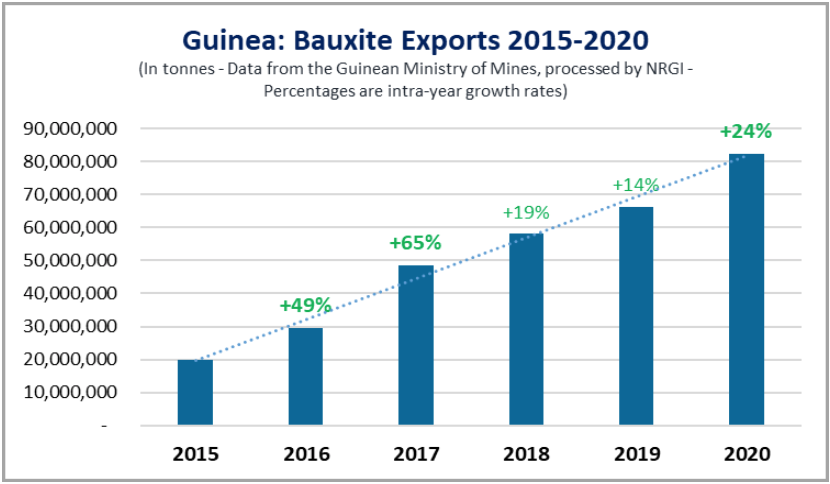

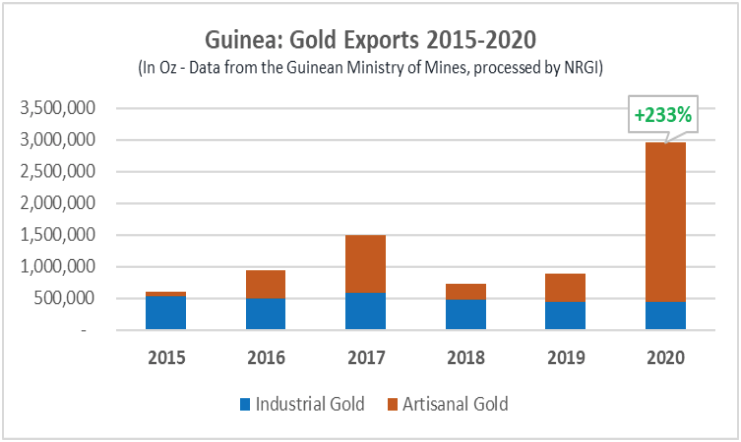

Guinea’s bauxite sector has been highly profitable because the production process is not complex, and the Guinean bauxite is one of the highest grades in the world (up to 49 percent compared to the 40 percent standard). The main production costs are related to transport from mine sites to ports for export. So far, the coronavirus pandemic has not affected the value chain in Guinea. Statistics published in February 2021 by the Ministry of Mines and Geology for 2020 confirm that bauxite exports continued to grow. The rate of growth (24 percent) was higher than in 2019 (14 percent) and 2018 (19 percent). Gold exports increased by 233 percent in 2020, reflecting the surge in artisanal gold exports (up by 465 percent) resulting from movement restrictions (due to the pandemic and elections) that reorientated gold trading to more formal channels.

As part of the government’s engagement in the diversification of mining products, Guinea signed an agreement in June 2020 with SMB Winning for blocs 1 and 2 of the Simandou iron ore deposit, and welcomed new entrants in the industrial gold sector, including Hummingbird and Sycamore Mining. The Ministry of Mines anticipates that bauxite production will continue to increase, feeding Guinea’s ambitions of being the world’s top bauxite producer in a couple of years. However, the easing of movement restrictions in the fourth quarter of 2020 led to a decline of gold exports, which may curb its exceptional performance. The downward trend in the aluminum price (minus 7 percent in 2020 compared to 2019) will likely continue to affect bauxite price and demand. If such a trend was confirmed in 2021, it would mean a slow-down in Guinean bauxite production and exports, and some of the 13,539 people directly employed in the sector could be furloughed.

Two factors could mitigate the effects of bauxite price and demand drops on government revenues if the pandemic persists: a continued upswing in economic activity in China (Guinea’s main customer); and a continued upward trend in the price of gold (plus 28 percent in 2020 compared to 2019), coupled with sustained high levels of Guinean artisanal gold exports.

Impact on revenues

Mining revenues represent 31 percent of government revenues (as per the 2018 EITI report) with bauxite accounting for 62 percent of mining revenues and gold for 22 percent. Guinea’s vulnerability to a decline in bauxite revenues is heightened by the impact that the coronavirus crisis has had on other sectors of the economy. As of September 2020, the Guinean Ministry of Budget had collected only 61 percent of the expected mining revenues, and, in March 2021, media reported on mining companies’ alleged financial distress due to the decline in bauxite price. However, the private sector has not made any public request for relief or changes to the terms of investment. At the general assembly of the Chamber of Mines on 13 December 2020, the minister of mines praised the resilience of mining companies and their exceptional efforts to preserve the health of their employees and to support communities and governments efforts. However, a deterioration of the financial situation for companies would likely lead them to request fiscal incentives or a lowering of standards. They would also likely either reduce or suspend their production, jeopardizing the government’s revenues.

Mining revenues allocated to municipalities usually represent less than 5 percent of all mining revenues. However, since the 2011/2013 mining code provisions related to the local development funds (Fonds de développement économique local (FODEL) and the Fonds national de développement local (FNDL)) came into force in late 2019, these allocations have increased. According to government data, in 2020 companies have paid GNF 199 billion (USD 20 million) to mining municipalities under FODEL. Under FNDL, the government transferred GNF 225 billion (USD 22 million) to all municipalities. A reduction of mining activity would affect such funds, with a one-year time lag. In fact, FODEL depends on the turnover of mining companies, and FNDL on the quantity of material that mines produce and export and on the aluminum price. In both cases, payments are made to municipalities the following year. In addition, the yearly amounts transferred under FNDL (GNF 362 billion planned for 2021) are particularly high compared to the estimates that are based on article 165 of the mining code, which set the calculation formula. This suggests that Guinea may be overspending on local development funds and could therefore risk not meeting the expectations of local communities in the future.

Another factor that may affect future revenues is the 20-year USD 20 billion credit line Guinea received from China in 2017. The government has disclosed details on the two resource-backed loans already drawn in 2018 from this line. Both loans, of EUR 329 million and EUR 186 million respectively, have a four-year grace period. This means that the repayment based on royalties from three Chinese mining companies’ production is scheduled to start in 2022, which is the delivery date for the road infrastructure for which the loan was taken (the infrastructure is being delivered by other Chinese firms). As the infrastructure work has slowed down due to restrictions on movement, and as the government mining revenues are affected by the pandemic, the repayment plan is unlikely to be met.

Impact on natural resource governance

The government is committed to abiding by the mining code. Guinea is attractive to investors in bauxite, iron ore and strategic minerals, like graphite, because of its exceptional reserves, high-grade ore and its mining code. Consequently, the government is less likely to deviate from the existing law, or to extend incentives to investors, except for integrated projects with infrastructure and refinery components. Moreover, the IMF’s support to Guinea is based on the assumption of the government complying with the mining code provisions.

The coronavirus pandemic and, since February 2021, the Ebola crisis, following closely on the heels of the electoral crisis in Guinea, are likely to cause government officials to focus on the immediate challenges, with little space for civil society advocacy for transparency and accountability. Except for a brief hiatus between September 2020 and February 2021, civil society actors have been, as in other countries, constrained by movement restrictions and social distancing measures that directly affect their usual consultation, training and advocacy activities.

The pandemic may also impact Guinea’s implementation of key elements of the EITI, a global good governance standard for oil, gas and minerals. In July 2020, the civil society constituency within the Guinea EITI multi-stakeholder group adopted a new code of conduct that addresses conflicts of interest, strengthens the accountability of civil society organizations and the participation of women and youth in the EITI process in Guinea. For the first time, civil society organizations independently designated their new representatives in September 2020 for a three-year mandate based on the new code of conduct. These new representatives aim to engage with the EITI process in a more reform-oriented and impactful way. The government released the 2018 EITI report in December 2020, with a six-month delay compared to its usual timing. This report, covering payments received from mining companies in 2018, contains interesting lessons on the state of the mining governance in 2020. Guinea’s EITI validation assessment that was due to start in August 2020 has been delayed twice and is now instead expected in July 2021. Meetings of the Guinea EITI multi-stakeholder group have resumed since January 2021. One of the challenges already being faced by the group is the production of the EITI 2019 report. In 2020 the government adopted the implementation decree of the 2017 corruption law on the asset-declaration regime and the whistleblowers’ and victims’ protection, in an effort to address corruption and as part of the requirements of the IMF program.

Looking forward

The mining sector’s activities in Guinea were largely unaffected in 2020, but, given the decline in the bauxite price, the story is different in terms of government revenues and the financial situation of companies. Vaccination campaigns in Guinea, including against Ebola, are ongoing, but the effects of the pandemic are expected to persist. This, coupled with a potential slowdown in the global economy, especially in China, threatens to impact the Guinean mining sector.

As the economic fallout of the coronavirus pandemic reverberates through the Guinean economy, the government may consider various measures. Increased transparency in this period is still necessary to allow all stakeholders to better understand and support the government's responses to the coronavirus impacts on the extractive sector. As mining companies are showing signs of financial distress, the government should be mindful of various risks, including that of “a race to the bottom”, when addressing company requests for relief and their increasingly likely decisions to lower or suspend production.

The government should consider a review of its two resource-backed loans. By having made public the terms of these agreements in 2020, the government has allowed all stakeholders to make a useful contribution to any review. Such a review may be warranted in light of the expected delays in delivering infrastructure, the risk of a decline in mining revenues, and the fact that China is looking at rescheduling debt in various countries in response to the effects of the pandemic’s.

The government should also anticipate the negative impact on subnational revenues. It may consider adjustments to the spending of mining revenues by entering negotiations with municipalities and being clear that allocations could substantially decrease from 2022 onward. Structural solutions to the risk of Guinean municipalities’ dependency on mining revenues are important, and the government should ensure it communicates its plans. Such plans for municipalities may include budgetary discipline measures, incentives to collect more domestic revenues, and technical assistance to develop income generating projects in other sectors to both diversify the economy from the ground up and build the resilience of a population that has become increasingly economically vulnerable because of the pandemic.

To preserve Guinea’s achievements in mining governance, the government should examine how it can make good governance processes more resilient. For example, the government could consider creating innovative online or remote forums for communication and consultation with mining sector stakeholders. It could also extend the digitization of mining administration by overhauling official websites and providing updated real-time information on mining activity, like the flexible reporting mechanisms that the EITI recommends as an adaptation to the pandemic.

Hervé Lado is the Guinea country manager with the Natural Resource Governance Institute (NRGI).