Commodity Rebound: How Governments Can Make the Most of an Early Christmas Present

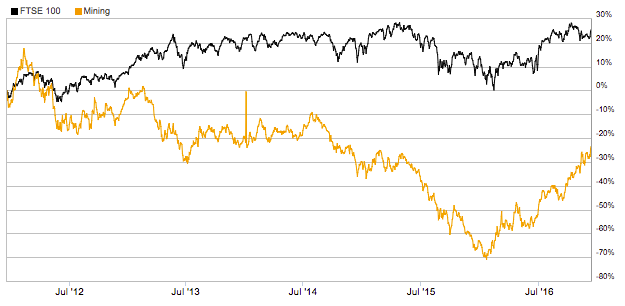

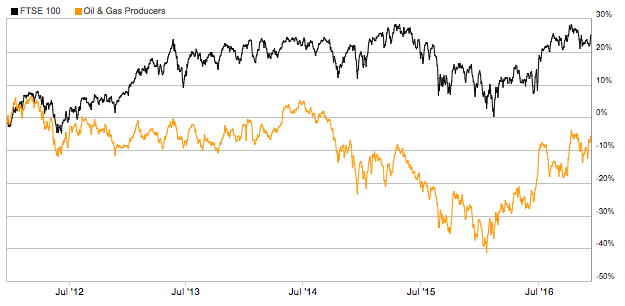

The agreement between OPEC producers last week raised the prospect of higher oil prices for the medium term. Over the last six months, other commodity prices have increased, and so have the prospects of many mining companies. The FTSE indexes for both mining and oil and gas producers have already made appreciable gains from their nadirs earlier in the year. Having cut costs from investments to operations over the last four years, mining company shareholders are expecting higher share profitability and dividend payments. [Paywalled link.]

Source: http://www.londonstockexchange.com

What should oil-rich and mineral-rich nations do about this?

- Recognize this development. There tends to be a lag between market developments and policy-making. Companies will very likely continue to use the “depressed market” narrative when asking for fiscal incentives, deregulation and government subsidies. [Paywalled link.] Governments should know better and develop a new narrative.

- Manage expectations. The recent rebound is still timid, and rests partly on the macro-fiscal policy of the Chinese government. [Paywalled link.] This year’s political events have created major uncertainties globally, and the future of commodity markets is likely to be volatile. Politicians should refrain from pitching oil or minerals as a solution to voters’ economic woes.

- Review companies’ environmental and social policies. Many miners pride themselves on having cut their costs over the last few years. Governments might want to ensure that these cost-cutting measures are not affecting companies’ ability to maintain strong environmental obligations and promote more prosperous communities.

- Recruit tax administrators. Lower extraction costs are in the interest of shareholders. They’re also in the interest of producing countries, especially if prices are rising again. But governments should ensure the costs declared to their tax administrations reflect the actual savings made by companies, so that higher global profits translate into higher tax receipts in resource-exporting countries. Tax inspectors are probably the smartest investment a government can make.

These measures can be taken in the short term, they will not hamper the recovery of commodity markets, and they are cheap. And together, they can ensure shareholders are not the only ones celebrating this Christmas.

Thomas Lassourd is a senior economic analyst at the Natural Resource Governance Institute.