Coronavirus and Guinea: How Officials Can Safeguard Mining Governance Achievements

Français »

This article first appeared in French in La Tribune Afrique.

When the coronavirus reached Guinea on 12 March, government officials feared mining sector development momentum would falter. The sector had been impacted during the Ebola outbreak there in 2013.

Guinea’s mining sector has rapidly expanded since reforms introduced by the 2011/2013 mining code. (Bauxite production has increased by an average of 27 percent each year since 2015.) This has legitimately fueled Guinea's ambitions to play a leading global mining role, particularly in bauxite and iron.

The arrival of the coronavirus, then, sent a chill down spines. Guinea's main client and partner in the sector, China, was where the virus surfaced. The Guinean government quickly asked mining companies to formulate a response plan to safeguard the health of workers and mining communities and to keep production and export operations going. A third of state revenues come from the sector. In mid-May, the country had more than 2,500 active coronavirus cases, but only one had been officially counted by the mining companies. It was quickly addressed.

The health crisis has impacted Guinea’s mining sector in four important ways.

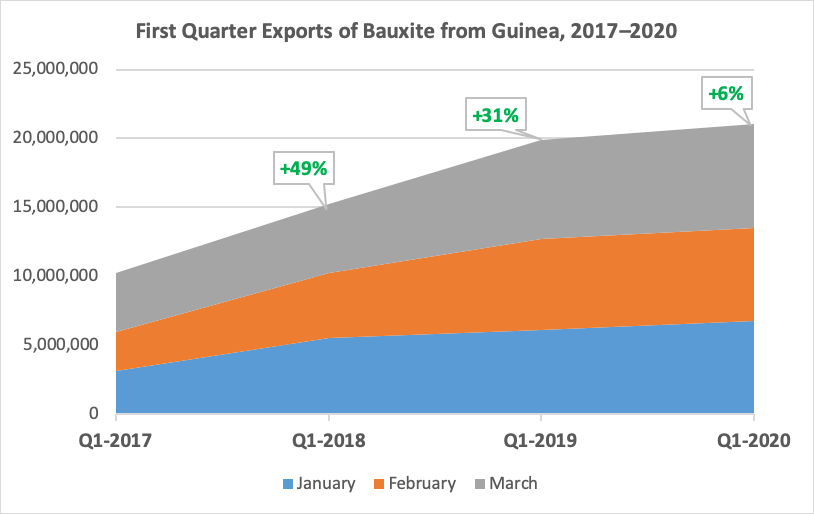

In the first quarter of 2020, mining production and exports were generally spared by the pandemic. Mining revenues were preserved. Quarter one 2020 statistics published in May by the Ministry of Mines and Geology confirm that bauxite exports continued to grow. There was, however, a slowdown compared to the trend observed over the last three years (an increase of 6 percent at the end of quarter one 2020 to 21 million tons, compared to +31 percent for quarter one 2019 and +49 percent for quarter one 2018).

A number of factors allowed for continued operations, often at the expense of mining companies: remote work for many administrative employees, steps to protect roles that demand in-person work essential to production and exports, and preventive measures in mining communities.

A global recession could thwart Guinea's mining ambitions and its financial balances. The government's projections, based on the production and investment plans of mining companies, assume that the trend observed in quarter one 2020 will be maintained. However, it is reasonable to suggest that the downward trend in the aluminium price (-19 percent in April 2020 compared to the average level in 2019) will eventually affect bauxite price and demand, particularly in the event of a global economic recession. Two factors could mitigate a drop in bauxite price and demand in the event of a global recession: China exceptionally resists the crisis by unexpectedly boosting its domestic market in the short term and a continued upward trend in gold price (+21 percent in April 2020 compared to 2019) sufficiently offsets a crisis in bauxite. In quarter one 2020, Guinean gold exports grew by 10 percent (to 244,342 ounces) compared to quarter one 2019, due to artisanal shipments (these jumped by a third). However, bauxite accounts for three-quarters of the country's mining revenues. Gold accounts for one-fifth.

A possible drop in mining activity would affect the mining funds allocated to communities, with a one-year time lag. Indeed, the two main subnational mining funds depend on the turnover of mining companies (FODEL – Fonds de développement économique local) and on the quantity of material produced and exported (FNDL – Fonds national de développement local), and are paid back to municipalities the following year. According to the quarter one 2020 statistics, since 2019, GNF 123 billion (USD 13 million) has been paid out by companies to mining municipalities under FODEL, of which 72 percent are actually allocated to around 1,000 local development projects. Under FNDL, GNF 191 billion (USD 20 million) was transferred by the government (ANAFIC, the Agence nationale de financement des collectivités) to all municipalities in the country for 791 projects. This is about 40 percent of the FNDL budget in the supplementary budget act of September 2019. These funds, therefore, still have some leeway that should be used sparingly.

The Guinean government's full engagement in the fight against the coronavirus deprioritizes some persistent governance issues. Many pushes related to transparency, accountability and citizen participation have been halted, including the many stakeholder consultation meetings that encourage real-time communication, monitoring and accountability. Production and export activities continue on the ground, as does the mobilization of subnational funds. Until the coronavirus is defeated, activities aimed at improving mining governance are on the back burner.

In light of these challenges, we have three recommendations for the government.

1. Harness new external funding opportunities to restore the other sectors of the economy, and consider a review of the resource-backed loans and agreements. The mining sector has emerged safe from quarter one 2020, but the story is different for other sectors of the economy. Their state of distress suggests a collapse of government revenues in 2020. Guinea should use new external funding opportunities (current public debt to GDP ratio is less than 45 percent) to rehabilitate these sectors, which employ massively and create value. The rehabilitation should be heavily prioritized. The government should also consider a review of the USD 20 billion agreement reached with China in 2017, whose repayments were to start in 2022 based on mining revenues. By making public the terms of the resource-backed loan and the status of its implementation, the government will allow all stakeholders in the sector to make a useful contribution to such a review. More broadly, NRGI’s experts have outlined possible responses for both oil producers and mining countries.

2. Negotiate now with local governments to stagger current FODEL and FNDL expenditures over several years, while being transparent that allocations could substantially decrease from 2022 onward. Beyond the negative effect of the coronavirus on mining and on these funds, it’s important to remember that 2019 allocations were particularly high because they contained sums unpaid to municipalities since 2015. It is also time for ANAFIC to find structural solutions to the risk of Guinean municipalities’ dependency on mining revenues.

3. Create and maintain innovative remote spaces for communication and consultations with mining sector stakeholders—particularly with civil society. Civil society actors are experiencing the harsh impact of restrictive pandemic measures that directly affect their usual consultation, training and advocacy activities. They are eager to engage. Given this reality, the efforts of the Ministry of Mines and Geology to quickly publish the quarter one mining statistics bulletin, including the first-time inclusion of payments relating to subnational funds, are to be commended. Indeed, the current health crisis, which could continue or resurface, calls for new ways of working. In order to preserve Guinea's achievements in mining governance, the government would benefit from producing and publishing the 2018 EITI report by June 2020, as initially planned. Furthermore, it’s the right time to extend the digitization of mining administration by overhauling official websites with information on the legal and regulatory framework of the sector, along with updated data on mining activities and projects. Increased transparency in this particular period would allow stakeholders to better understand and support the government's responses to the coronavirus in the sector, including possible adjustments in the collection, redistribution and allocation of mining revenues.

Hervé Lado is the Guinea country manager with the Natural Resource Governance Institute (NRGI).

This article first appeared in French in La Tribune Afrique.

When the coronavirus reached Guinea on 12 March, government officials feared mining sector development momentum would falter. The sector had been impacted during the Ebola outbreak there in 2013.

Guinea’s mining sector has rapidly expanded since reforms introduced by the 2011/2013 mining code. (Bauxite production has increased by an average of 27 percent each year since 2015.) This has legitimately fueled Guinea's ambitions to play a leading global mining role, particularly in bauxite and iron.

The arrival of the coronavirus, then, sent a chill down spines. Guinea's main client and partner in the sector, China, was where the virus surfaced. The Guinean government quickly asked mining companies to formulate a response plan to safeguard the health of workers and mining communities and to keep production and export operations going. A third of state revenues come from the sector. In mid-May, the country had more than 2,500 active coronavirus cases, but only one had been officially counted by the mining companies. It was quickly addressed.

The health crisis has impacted Guinea’s mining sector in four important ways.

In the first quarter of 2020, mining production and exports were generally spared by the pandemic. Mining revenues were preserved. Quarter one 2020 statistics published in May by the Ministry of Mines and Geology confirm that bauxite exports continued to grow. There was, however, a slowdown compared to the trend observed over the last three years (an increase of 6 percent at the end of quarter one 2020 to 21 million tons, compared to +31 percent for quarter one 2019 and +49 percent for quarter one 2018).

A number of factors allowed for continued operations, often at the expense of mining companies: remote work for many administrative employees, steps to protect roles that demand in-person work essential to production and exports, and preventive measures in mining communities.

A global recession could thwart Guinea's mining ambitions and its financial balances. The government's projections, based on the production and investment plans of mining companies, assume that the trend observed in quarter one 2020 will be maintained. However, it is reasonable to suggest that the downward trend in the aluminium price (-19 percent in April 2020 compared to the average level in 2019) will eventually affect bauxite price and demand, particularly in the event of a global economic recession. Two factors could mitigate a drop in bauxite price and demand in the event of a global recession: China exceptionally resists the crisis by unexpectedly boosting its domestic market in the short term and a continued upward trend in gold price (+21 percent in April 2020 compared to 2019) sufficiently offsets a crisis in bauxite. In quarter one 2020, Guinean gold exports grew by 10 percent (to 244,342 ounces) compared to quarter one 2019, due to artisanal shipments (these jumped by a third). However, bauxite accounts for three-quarters of the country's mining revenues. Gold accounts for one-fifth.

A possible drop in mining activity would affect the mining funds allocated to communities, with a one-year time lag. Indeed, the two main subnational mining funds depend on the turnover of mining companies (FODEL – Fonds de développement économique local) and on the quantity of material produced and exported (FNDL – Fonds national de développement local), and are paid back to municipalities the following year. According to the quarter one 2020 statistics, since 2019, GNF 123 billion (USD 13 million) has been paid out by companies to mining municipalities under FODEL, of which 72 percent are actually allocated to around 1,000 local development projects. Under FNDL, GNF 191 billion (USD 20 million) was transferred by the government (ANAFIC, the Agence nationale de financement des collectivités) to all municipalities in the country for 791 projects. This is about 40 percent of the FNDL budget in the supplementary budget act of September 2019. These funds, therefore, still have some leeway that should be used sparingly.

The Guinean government's full engagement in the fight against the coronavirus deprioritizes some persistent governance issues. Many pushes related to transparency, accountability and citizen participation have been halted, including the many stakeholder consultation meetings that encourage real-time communication, monitoring and accountability. Production and export activities continue on the ground, as does the mobilization of subnational funds. Until the coronavirus is defeated, activities aimed at improving mining governance are on the back burner.

In light of these challenges, we have three recommendations for the government.

1. Harness new external funding opportunities to restore the other sectors of the economy, and consider a review of the resource-backed loans and agreements. The mining sector has emerged safe from quarter one 2020, but the story is different for other sectors of the economy. Their state of distress suggests a collapse of government revenues in 2020. Guinea should use new external funding opportunities (current public debt to GDP ratio is less than 45 percent) to rehabilitate these sectors, which employ massively and create value. The rehabilitation should be heavily prioritized. The government should also consider a review of the USD 20 billion agreement reached with China in 2017, whose repayments were to start in 2022 based on mining revenues. By making public the terms of the resource-backed loan and the status of its implementation, the government will allow all stakeholders in the sector to make a useful contribution to such a review. More broadly, NRGI’s experts have outlined possible responses for both oil producers and mining countries.

2. Negotiate now with local governments to stagger current FODEL and FNDL expenditures over several years, while being transparent that allocations could substantially decrease from 2022 onward. Beyond the negative effect of the coronavirus on mining and on these funds, it’s important to remember that 2019 allocations were particularly high because they contained sums unpaid to municipalities since 2015. It is also time for ANAFIC to find structural solutions to the risk of Guinean municipalities’ dependency on mining revenues.

3. Create and maintain innovative remote spaces for communication and consultations with mining sector stakeholders—particularly with civil society. Civil society actors are experiencing the harsh impact of restrictive pandemic measures that directly affect their usual consultation, training and advocacy activities. They are eager to engage. Given this reality, the efforts of the Ministry of Mines and Geology to quickly publish the quarter one mining statistics bulletin, including the first-time inclusion of payments relating to subnational funds, are to be commended. Indeed, the current health crisis, which could continue or resurface, calls for new ways of working. In order to preserve Guinea's achievements in mining governance, the government would benefit from producing and publishing the 2018 EITI report by June 2020, as initially planned. Furthermore, it’s the right time to extend the digitization of mining administration by overhauling official websites with information on the legal and regulatory framework of the sector, along with updated data on mining activities and projects. Increased transparency in this particular period would allow stakeholders to better understand and support the government's responses to the coronavirus in the sector, including possible adjustments in the collection, redistribution and allocation of mining revenues.

Hervé Lado is the Guinea country manager with the Natural Resource Governance Institute (NRGI).