As Extractive Economies Struggle, Eurasian Stakeholders Devise Solutions

In this era of low commodity prices, oil- and mineral-rich governments in Eurasia are under acute financial pressure.

Mongolia, which borrowed heavily in the days of the resource boom, is now facing a fiscal crisis, and major spending cuts are underway. Azerbaijan and Kazakhstan are fast depleting their oil funds. While Kazakhstan has less to worry about—it has a much larger sovereign wealth fund and over 60 years of remaining oil and gas reserves—Azerbaijan will likely run out of oil around 2030, causing great concern for the country’s overall prospects.

While the extractive sectors in Kyrgyzstan and Tajikistan are less developed, their potential is large—the mining sector brings the hope of reducing poverty and providing a source of financing for economic development. But in both countries, as elsewhere, new mining investments have dried up.

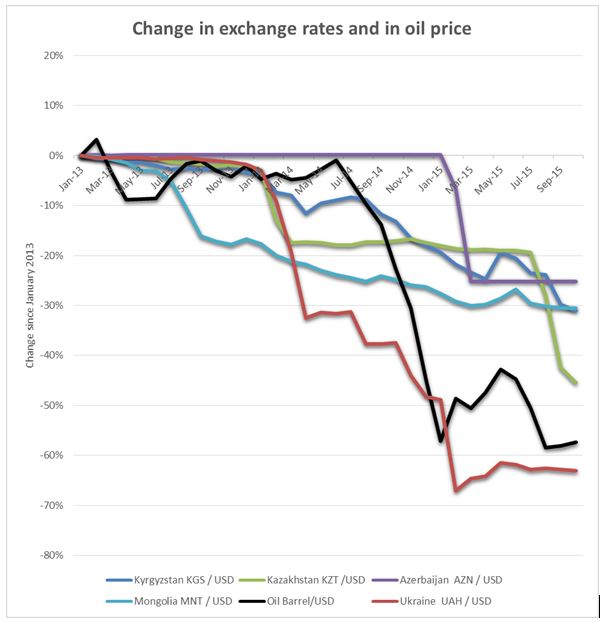

And throughout the region, currencies have been in freefall, making life tough on populations dependent on imported goods.

Sources: Exchange rates from Oanda.com, Brent oil price from Indexmundi

Even Ukraine, which is not normally considered resource-rich and is a net energy importer, collects $2 billion to $4 billion each year from transiting natural gas, and is a large mineral producer. Furthermore, Naftogaz, the national oil company, is a drain on public finances rather than a contributor.

To discuss how governments in the region can respond to these challenges, NRGI’s Eurasia Knowledge Hub recently organized a three-day course in Istanbul on the management and distribution of natural resource revenues.

Twenty-five participants from government, civil society and the private sector attended, coming from Azerbaijan, Ukraine, Kazakhstan, Mongolia, Kyrgyzstan and Tajikistan.

Rafika Musoeva, Tajikistan’s former minister of labor and social defense, and Ahmad Gumbatov, of Azerbaijan’s Caspian Center for Energy and Environment, both participated in the course.

NRGI staff, in collaboration with independent economist Kenan Aslanly led theoretical and applied sessions on the management and distribution of extractive revenues.

Participants worked in country teams, bringing together different expertise and perspectives. Using the theory and concepts discussed during the training and economic data from the region, they discussed the issues crucial to transforming their natural resource wealth into development, such as combating volatility; establishing or strengthening a national resource fund; identifying spending and revenue collection measures to address budget shortfalls; restoring trust in the national currency; and pushing reforms to increase accountability in oil and mineral wealth management. The presentations on the last day merged natural resource economics with innovative data visualization techniques introduced during the course. This allowed participants to practice making persuasive presentations to policymakers.

Participants said the session would empower them to adapt their work to new challenges faced in the region. “We used to work on budget-related issues at the subnational level,” said Aigul Jaras, director of Kazakhstan’s Center for Economic Research, Evaluation and Monitoring. “The level of participation of people in the budget process at the subnational level is very low. I will use the skills I’ve obtained in this course to advocate for crisis impact mitigation in my country.”

Fidan Bagirova is NRGI’s Eurasia senior officer. David Mihalyi is an NRGI economic analyst. Andrew Bauer is NRGI’s senior economic analyst.