Governance of Tunisia’s State-Owned Oil Company: Concrete Steps for Progress

Tunisia’s new reformist government has committed to fight corruption and boost investment and growth, amid growing concern about the potential of Tunisia’s oil and gas sector to attract foreign investment and reduce growing energy trade deficits in the long term.

This comes at a time when oil contracts have been published on the Ministry of Energy and Mines’ open data platform and NRGI’s resource contracts platform has made access to documents easier. Tunisia’s natural resource authorities, once characterized by opacity and lack of sound management, are showing tremendous progress towards more transparency in the oil and gas sector.

The challenge today, while leveraging transparency gains to improve Tunisia’s attractiveness for foreign investors, is to concentrate efforts on enhancing the governance and performance of Tunisia’s state-owned oil company, ETAP (Entreprise Tunisienne des Activités Petrolières).

Building on previous research and recommendations in the guide on governance and integrity for state-owned companies in Tunisia published by the Arab Institute of Business Leaders (IACE), NRGI and IACE conducted research on ETAP’s governance system and performance. Our study aims to shed light on the key challenges facing the company and provides policymakers and other stakeholders with recommendations for making ETAP a more accountable and effective public enterprise.

Tunisia, a net oil importer, is a small producer compared to its regional neighbors like Egypt. Nevertheless, ETAP’s total revenues are equal to 13 percent of the country’s central budget revenues in 2013. That same year, Tunisia’s hydrocarbon sector represented 6.5 percent of GDP in 2013 and 15 percent of exports. Lack of transparency and accountability in managing this sector can seriously undermine the ability of the state to meet social and pro-growth investment spending commitments.

Challenges in ETAP current governance system

ETAP is under the purview of the Ministry of Energy and Mines, and conducts exploration, development and sales activities in relation to oil and gas as well as economic and technical feasibility studies on hydrocarbons-related projects. The company currently operates through joint venture agreements or production sharing contracts signed with private companies.

Assessment of the different components of the company’s governance structure and operational practices reveals sizable shortcomings in major areas.

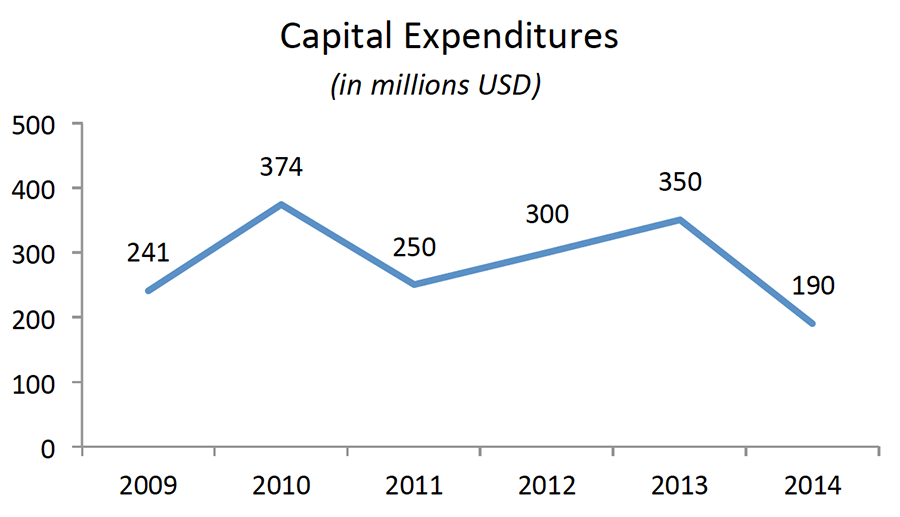

First, the legal and institutional framework governing ETAP is quite rigid and does not allow the company to operate in a competitive and effective manner within the sector. Capital expenditures have been on a downward trend since 2010 while employment increased by 30 percent in 2011 without proper recruitment policies and human resource management in place.

Source: ETAP Annual Report 2014

Source: ETAP Annual Report 2014

Second, disclosure of information is still incomplete. Outsiders can’t access detailed financial and budgetary information or data about transfers from and to the treasury, or any information about disclosure of quasi-fiscal activities, such as the financing of energy subsidies, infrastructure and social services. (The last of these is a node of significant underperformance for many national oil companies.)

Finally, the company’s internal corporate governance mechanisms—namely the board of directors, the internal audit and the governance cell functions—are all lacking transparency and effectiveness. Although the company is controlled by various external entities within the public administration (e.g., the court of account, the state controllers of the presidency and other inspection bodies within relevant ministries), the lack of coordination among these control agencies is a problem.

Improving ETAP’s performance and governance practices

Our study surfaces a number of recommendations that could help pave the way for more transparency and accountability in the management of Tunisia’s oil sector. The study recommends the following:

- Better delineate and define the company’s status and objectives and the role of the state as a standalone shareholder through the reactivation of the so-called contrat- programme tool. The tool provides a medium-term framework that enables the company to assess trade-offs between its commercial strategy and development strategy, looking into areas of specialization. This has proved to be effective in other emerging producer countries.

- Promote investment in the energy sector in line with a long-term strategy.

- Increase transparency through further disclosure of information as part of an overall communication strategy. Tunisia’s adherence to EITI can be seen as a step forward, and would require from ETAP further disclosures.

- Empower and strengthen a professional and independent board of directors.

- Invest in human resource capacity building and in designing a proper code of conduct.

- Monitor results of sustainable development programs.

The preliminary version of the study was extensively discussed at the IACE’s high-level forum on governance, where ETAP CEO Mohammed Akrout said, “We welcome the recommendations in line with international best practices and are keen to push for further information disclosure as long as it is under ETAP’s mandate.” This underscores the confusion around which activities fall under ETAP’s control and which are the responsibility of the Ministry of Energy and Mines. We hope the study will provide explanations on the challenges faced by ETAP among other players and serve as a driver of a larger debate on the necessity for reforming and strengthening Tunisia’s state-owned enterprises in various key economic sectors.

A summary guide presenting recommendations based on the study findings is available here.

Nadine Abou Khaled is a MENA senior economic analyst at NRGI. Majdi Hassen is the executive director of IACE.