National Oil Company Database Update: How Did NOCs Respond to the 2020 Price Decline?

On 18 May, NRGI published the latest update of the National Oil Company Database, a free website that provides standardized and contextualized data on 71 national oil companies (NOCs), covering production, revenues and spending. NRGI updates the database semiannually—in May and December—using information published in official company or government reports.

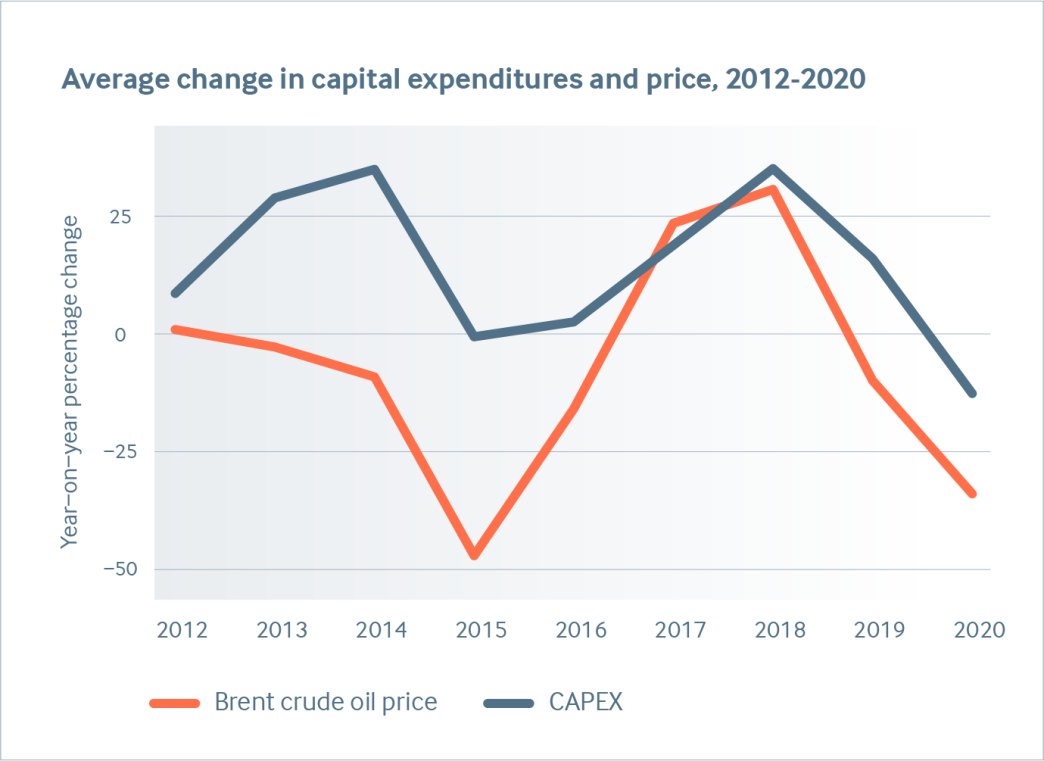

With data now extending through 2020 for most companies and through 2021 data for nine others, NRGI has examined how NOCs responded to the sharp decline in oil prices in 2020 in this infographic. Since the lows in 2020, prices have climbed throughout 2021, reaching record highs this year. However, the way NOCs responded in 2020 may indicate how companies will—or won’t—change course in the face of the longer-term market decline anticipated as the energy transition unfolds.

As expected, financial transfers from NOCs to governments declined in 2020, reaching a new low for the decade covered by the database (2011-2021). However, this is not to say that contributions were not significant: transfers from NOCs accounted for well over 50 percent of the $600 billion governments collected from upstream oil and gas extraction in 2020. In terms of spending, NOCs appear to be increasingly reactive to market conditions, as our analysis shows a clear reduction in NOC capital expenditures in 2020. During the previous price decline in 2015, NOC investment growth stalled but didn’t drop (on average).

The energy transition could result in hundreds of billions of dollars of NOC investments in new projects becoming stranded, so it is particularly concerning that many companies remain opaque. For 2020, total revenue information is absent for around half of NOCs, as some do not report at all and others report with significant delays. Also notable absences in this update are Russia’s state-owned enterprises, Rosneft and Gazprom. Their annual reporting would typically be out by this point in the year, and while some news outlets have reported profit data, we have not been able to access any official reports for 2021.

In this round of data collection, we found a few large NOCs (Petrobras, Ecopetrol and Equinor) disclosing capital guidance on planned investments for decarbonization initiatives. This information is crucial to analyzing the energy transition pathways of national oil companies and we will continue researching decarbonization spending to include historical data as an indicator in future editions.

NRGI is using the National Oil Company Database extensively in its research and work on national oil companies and the energy transition. The purpose of the database is to advance public knowledge, and my NRGI colleagues and I find it encouraging to see the database being utilized as a resource in the production of vital research on the future of fossil fuel production such as the Production Gap Report, the EBRD’s Transition Report, and the Environmental Defense Fund’s Transferred Emissions report.

We designed the database with the researcher and data analyst in mind. The website provides several options for downloading data, a repository of original sources, and R code for analysis. Anyone utilizing the National Oil Company Database should contact us at nocdata@resourcegovernance.org with any questions or suggestions.

The next update of the National Oil Company Database is scheduled for December 2022.