Zambia's New Mining Tax Regime May Fail the Test of Time

After enjoying one of the greatest mining booms in its history, Zambia is now suffering. The price of copper—a metal on which much of the country depends—has fallen by half in the last five years. This fall has resulted in the loss of thousands of jobs and the deterioration of government finances. The signs of an emerging middle class in the country are fading: the shopping malls, stadiums and 3-D cinemas built when copper prices and expectations for the future were high are increasingly empty.

This presents the government of Zambia with a severe challenge. Officials must preserve mining revenues to fund the budget and avoid further mine closures and a drop in investment in the sector. In response to this challenge, the government has proposed a new tax regime as part of the 2017 budget. The regime contains three significant changes:

- removal of the 9 percent royalty on copper

- introduction of a “price-based royalty,” the rate of which varies according to the price of red metal

- removal of the variable profit tax

These changes are the latest in a long series of policy reversals, reversing an extreme increase in the royalty rate only last year, so Zambians might question whether this regime will last any longer than the rest. To answer this, I put together two charts showing that while the tax changes will help Zambia in the short-term, the new tax regime will not be flexible enough to adapt to further changes in the future.

The tax burden on companies will lessen, which is positive given current low prices

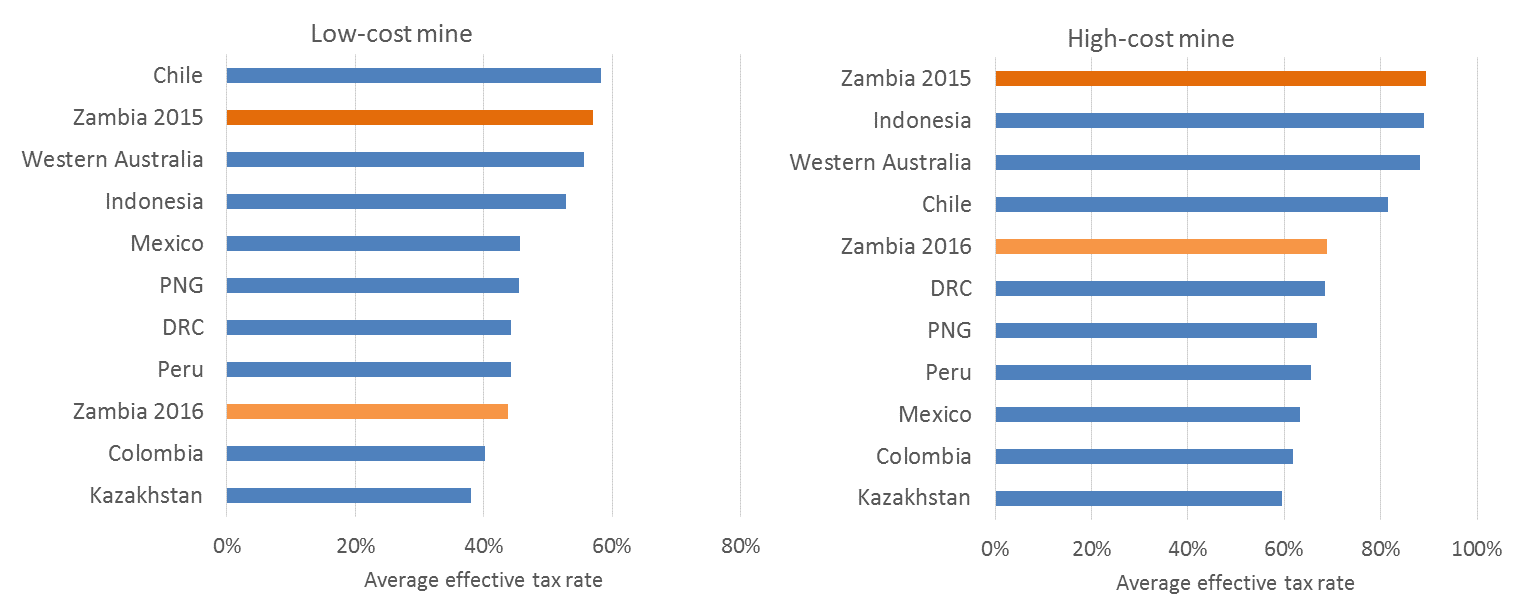

My analysis shows that the latest reforms significantly relieve the burden of tax for mining companies. The chart below compares the estimated tax burden of the new and old Zambian mining tax regimes, as well as that imposed by the mining tax regimes of other major copper-producing countries. The chart includes estimates for low-cost and a high-cost mining project to represent the range of typical projects found in Zambia. For both types of projects, the tax burden has fallen considerably. For operators of high-cost mines—most mines in Zambia are high-cost—this is welcome relief, particularly given the current low prices. If the government wants to keep its higher-cost mines in operation and ensure a stream of revenues and jobs, this relief is probably sensible.

Chart 1. Estimated tax burden (average effective tax rate) for Zambia’s tax regimes and copper-producing peer countries

When prices rise, Zambia will miss out

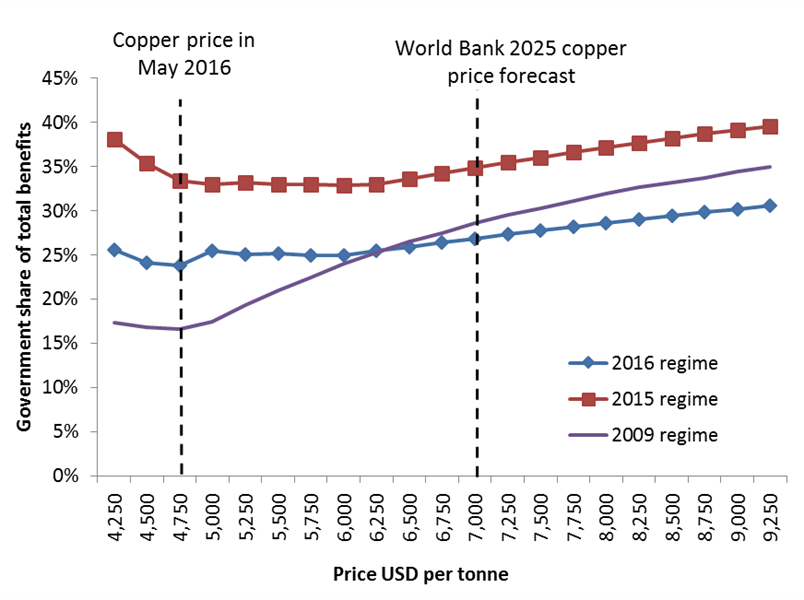

However, if prices rise again, the government is likely to receive a smaller share of income than if it had stuck with one of the previous tax regimes. This is because the removal of the variable profit tax, and the design of the price-based royalty, ensures that the new tax regime is less progressive than previous regimes. The chart below shows how the government’s share of total benefits from a typical mining project changes as the price of copper rises. It compares the new regime with the 2015 regime and the 2009 regime, the latter included to illustrate how a reasonably progressive regime is more responsive to price changes.

For example, compare the 2009 and 2016 regimes in Chart 2. At a low price of USD 4,750 per tonne – the current price of copper – the 2009 regime takes only 17 percent of the total benefits generated by a mining project, giving relief to the company that might otherwise be forced to close down. In comparison, the 2016 regime places a relatively high burden on companies, although not as high as the 2015 regime. On the other hand, at a price of USD 7,000 per tonne (as forecasted by the World Bank) the share of benefits taken by the government rises considerably under the 2009 regime, but grows much slower under the 2016 regime.

Chart 2. Modeled government share of total project benefits for different copper price assumptions

This difference in progressivity is a double-edged sword for policy makers in Zambia. Variable taxes automatically provide relief to companies when prices are low, while capturing more of the rent when prices are high. However, there are two concerns with progressive regimes. First, precisely because variable taxes provide relief when taxes are low, these types of tax regimes also automatically reduce the revenues being paid to government. As Chart 2 shows, the 2009 regime is more progressive than the other regimes, and has the lowest government take when prices are low. Second, progressive regimes usually rely on profit-based tax types that are somewhat harder to administer than royalties and other revenue-based taxes: the types to which the government has now turned with the 2016 regime.

Still, by automatically adapting to changes in profits, progressive regimes do at least remove some of the pressure to constantly change tax rules. Instead of sticking to one progressive tax regime that automatically responds to changing market conditions, Zambian governments have responded to these changes by frequent reforms that are potentially damaging to investor’s and citizens’ trust.

Policymakers are interested in a tax regime that is progressive, relatively simple to administer, and does not expose the treasury to significant revenue risk if prices slump. Unfortunately, the logic of tax design means that the government cannot get a tax regime that does each of these three things perfectly. In the new regime, the government has effectively traded progressivity for greater simplicity and less risk exposure. This is understandable given how difficult the authorities have found administering the regime and collecting taxes, but the key is to understand what balance is appropriate for the country.

While the government may be reluctant to change the regime yet again, my analysis suggests that they may face public pressure to do so again in the future. Better to think through the issues now without this additional pressure. Whatever changes they make, the government could be more open in how it makes policy decisions, involve a greater range of people and show its thinking before it acts. Publish What You Pay Zambia and Zambia Tax Platform have called for the “government to consider engaging in a more consultative and participatory process in developing taxation regimes.” Following this advice is not as easy as simply publishing some documents, but some openness would be a step in the right direction and help build a better tax regime for the future.

David Manley is an economic analyst at the Natural Resource Governance Institute (NRGI) and a former senior economist at the Zambia Revenue Authority.

Authors

David Manley

Lead Economic Analyst – Energy Transition