2021 Resource Governance Index: Nigeria (Oil and Gas)

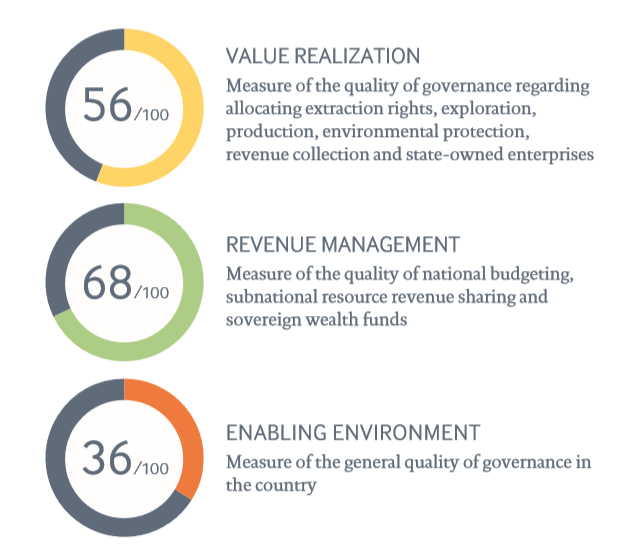

Nigeria’s oil and gas sector scored 53 points in the 2021 Resource Governance Index (RGI), placing it in the “weak” performance band. Despite an 11-point score increase since the 2017 RGI, petroleum resource governance has largely stagnated in that time, with the bulk of the increase driven by the first-time inclusion of the Nigeria Sovereign Investment Authority (NSIA) in the assessment. Barring this inclusion, significant governance challenges remain, with deep-seated, and long-standing issues hampering possible improvements.

Key messages:

- The governance of licensing remains “failing,” due to an absence of a centralized cadaster and rules governing the pre- and post-licensing process and contract disclosures.

- The lack of disclosure of public officials’ financial interests in extractive companies and limited disclosure of significant beneficial ownership information remain a concern.

- Governance of state-owned Nigeria National Petroleum Corporation (NNPC) improved by 25 points since the 2017 RGI, driven mostly by enhanced commodity sales disclosures.

- The Nigerian Sovereign Investment Authority was assessed for the first time, and placed in the “good” performance band for sovereign wealth funds due to strong rules and disclosures governing the fund.

- Nigeria’s “poor” enabling environment hinders its petroleum resource governance, with subcomponents related to control of corruption, political stability and government effectiveness all receiving “failing” scores.

NRGI recommends the following courses of action for the improvement of oil and gas sector governance in Nigeria:

- The Minister of Petroleum Resources should ensure that the articles of association for any new NNPC entities created by the PIA contain binding obligations to publish audited financials and detailed commodity sale data.

- The Ministry of Petroleum Resources, alongside the Department of Petroleum Resources, NNPC and the Ministry of Environment should disclose more information on the climate risks and impacts of the country’s existing and planned oil and gas sector operations.

- The president should create a multi-stakeholder task force, with representatives from all relevant government bodies, a range of civil society organizations, research institutions and communities, to develop an evidence-based, consultative energy transition plan for Nigeria.

- The Federal Government should consolidate its stabilization mechanisms, utilizing the Nigerian Sovereign Investment Authority (NSIA) which has proven to be more effective than its predecessors.