Myanmar: Updated Assessment of the Impact of the Coronavirus Pandemic on the Extractive Sector and Resource Governance

This is one of a series of country briefings produced by NRGI to summarize the evolving situation with respect to the pandemic and its economic impacts. The analysis it contains is subject to change with circumstances, and may be updated in due course.

Key messages

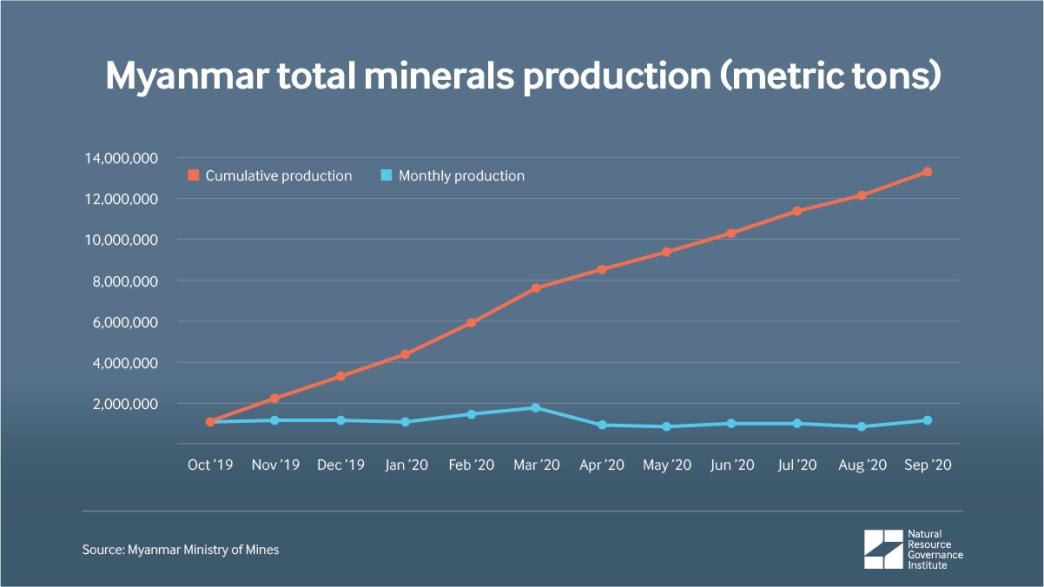

- Extractive activity has continued in Myanmar during the pandemic although to different degrees—gas production has decreased, while overall mineral production has largely remained the same. There are no official data on jade and gemstone production.

- Due to lower prices and demand for several commodities, including gas and jade, Myanmar government revenue from the extractive sector will drop in 2020 and 2021. It is difficult to assess the full impact on the sector because of limited transparency, including around extractive sector contracts and agreements on gas sales.

- State-owned Myanma Oil and Gas Enterprise (MOGE) will likely spend more than it earns in 2020 and 2021, becoming a net drain on Myanmar’s national budget.

- Having secured a landslide election victory on 8 November 2020, Myanmar’s National League for Democracy (NLD) will have significant influence in key natural resource ministries. The NLD has reached out to ethnic parties– including those representing resource-rich constituencies– seeking to work together. The implications for subnational resource governance are uncertain.

- The pandemic’s impacts may endanger the progress that Myanmar has made on transparency and civil society engagement in the extractive sector. Civil society organizations need more support to continue operations and hold ground during this time.

The coronavirus pandemic’s economic impact

The coronavirus pandemic has severely impacted Myanmar’s economy. In May 2020, the World Bank predicted that the country’s growth for fiscal year (FY) 2019/2020 would drop from an expected 6.3 percent to 2 percent. (Myanmar’s fiscal year runs from October to September.) Barely one month later, the bank further downgraded growth estimates to just .5 percent.

Starting in August, the country saw an increase in coronavirus cases. According to the official data, Myanmar’s positive coronavirus cases and deaths per capita are among the lowest in the world. However, the true figures are likely to be higher, as Myanmar ranks among the countries that have conducted the fewest coronavirus tests per capita. The government introduced additional movement restrictions in September 2020 in an effort to limit the spread of the virus.

The economic downturn reflects the contraction of several key sectors of Myanmar’s economy, such as services and industrial manufacturing, which have suffered from both movement restrictions and decline in global demand. In addition, the return of large numbers of migrant workers from neighboring countries is leading to a reduction in remittances and an increase in the number of households living below the poverty line.

The country’s extractive sector has been less affected by the pandemic than other sectors and has largely continued to operate despite restrictions. However, available information shows that both lower demand for some commodities and price drops will further reduce revenues from the various extractive sub-sectors. For instance, the World Bank estimated that Myanmar’s non-tax revenues will decline by 12 percent in FY 2019/20, partly driven by the decline in natural gas revenues.

In April 2020, the government released an economic package called Overcoming as One: COVID-19 Economic Relief Plan (CERP) in response to the pandemic. It received some international support for the plan, which included a $50 million loan from the World Bank to strengthen the healthcare system and $356.5 million in emergency assistance from the International Monetary Fund (IMF). The CERP was followed by the draft Myanmar Economic Recovery and Reform Plan (MERRP) in October 2020. Extractive companies benefited from waivers to the two percent withholding tax on exports, as well as tax credits lowering corporate income tax payments, which both represent reductions in fiscal revenues without noticeable increases in investment.

The approved government budget for FY 2020/2021, covering October 2020 through September 2021, is 34.1 trillion kyat ($26.4 billion) and the budget deficit is expected to be 6.2 trillion kyat ($4.7 billion). This may be an underestimate since the Myanmar government projection for FY 2019/2020 budget deficit was already at 6.7 trillion kyat ($5.2 billion) in December 2019 before the pandemic impacted the economy.

Impact on the oil and gas sector

Myanmar’s hydrocarbon sector mainly comprises natural gas projects and is based on long-term export agreements with Thailand and China. In early 2020, government sources claimed no immediate reduction in the volume of gas production despite the global drop in prices. However, subsequent calculations by the World Bank show a decrease in exports of 25 percent in January and February 2020 compared to the same period in 2019. This drop in exports is likely to be exacerbated by China’s suspension of all global gas imports in March 2020, citing force majeure, as well as lower demand for gas from Thailand.

Myanmar had planned to commence international bidding for offshore gas fields in 2020 after finalizing a new production sharing contract. However, this is unlikely to proceed due to the political transition period following the general election in November 2020 and the coronavirus pandemic. Additionally, with the pandemic eroding the revenue and profit base of multinational corporations, there will likely be less interest from investors.

The low global oil price has also affected artisanal oil production. This activity is poorly regulated but a source of livelihood for thousands of people in some onshore oil-producing areas.

Artisanal oil production in Myanmar (Matt Grace for NRGI)

Impact on the mineral and gemstone mining sector

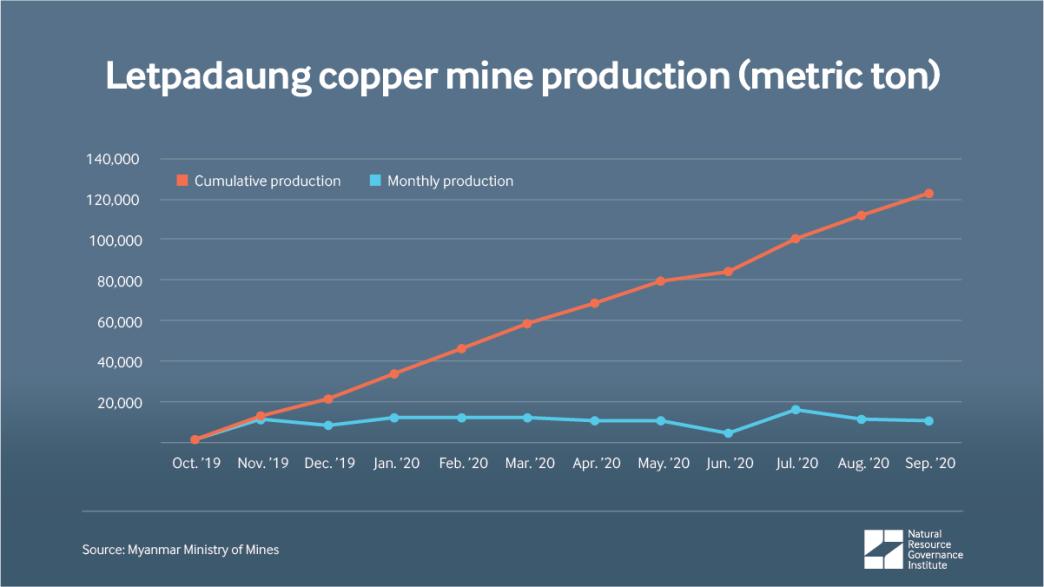

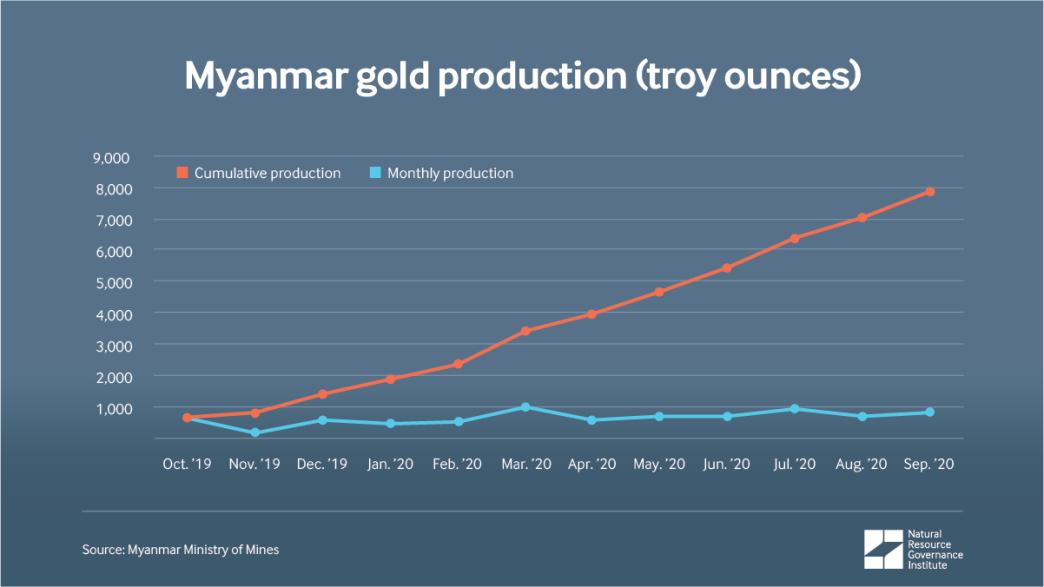

Most large-scale mineral mining projects—such as the Letpadaung copper mine and the Tagaung nickel mine—have continued to operate during the pandemic. Official government data for FY 2019/2020 show only a small decrease in monthly aggregated mineral production since April 2020 when Myanmar had its first outbreak of coronavirus. Letpadaung copper mine (one of the largest copper mines in Asia) maintained average production volumes of around 10,000 metric tons per month throughout the fiscal year. Cumulative gold production, from joint ventures at various locations, also held steady at around 650 troy ounces per month throughout the year.

In addition to maintaining production volumes, Myanmar has issued new mining licenses during the pandemic. In March, the Kachin State government issued more than 200 small-scale and subsistence gold production licenses. In May, the Ministry of Natural Resources and Environmental Conservation (MONREC) awarded an exploration license for a 750 square-kilometer area in the Sagaing region to PanAust, a copper and gold producer incorporated in Australia that is a subsidiary of Chinese state-owned enterprise Guangdong Rising Assets Management. The award of licenses has raised questions about whether appropriate social and environmental safeguards can be implemented during the pandemic. Media reports early in the year suggested that the authorities planned to issue further mining licenses, but government sources have recently told NRGI that negotiations for new exploration and production licenses have been put on hold due to travel restrictions and the continuing coronavirus outbreak in Myanmar.

The pandemic has not had a significant impact on official jade and gemstone production. Despite movement restrictions and moratorium on licensing that has been in place since April 2016, artisanal mining has continued. In July 2020, a landslide at Hpakant in Kachin state, a major mining site for jade extraction, resulted in more than 170 casualties. This tragedy highlights, once again, how thousands of artisanal miners operate with insufficient governance and safety measures.

In addition, the Kachin State government opened two concession rounds for artisanal mining in March and August 2020. The decision to issue licenses at the subnational level at this time is concerning. The draft Gemstone Rules, which will provide the basis for jade and gemstone decentralization– allowing subnational authorities to issue artisanal and small scale concessions– has not been enacted. Without clarity on the status of the rules that will regulate the sector, there is the risk of inadequate processes to check the track records of license holders, manage the social and environmental impacts and coordinate the licensing at national and subnational levels.

Impact on revenues from the extractive sector

Based on the latest Myanmar Extractive Industries Transparency Initiative (EITI) data covering FY 2017/2018, the extractives sector accounts for 4.8 percent of the country’s gross domestic product, 5.2 percent of the government revenue and 35 percent of all exports. The majority of extractive revenues in that year came from oil and gas (72 percent, in comparison to the jade and gemstones and mineral sectors at 21 percent and 6 percent, respectively).

Overall, extractive revenues in Myanmar will drop in 2020 and 2021, not entirely due to the coronavirus pandemic. They have been declining over the last several years due to several factors, such as the government not issuing mineral mining and gemstones licenses and the plateauing of production from old gas fields and phasing out in others. We discuss the revenue issues by extractive sub-sector below:

Oil and gas sector

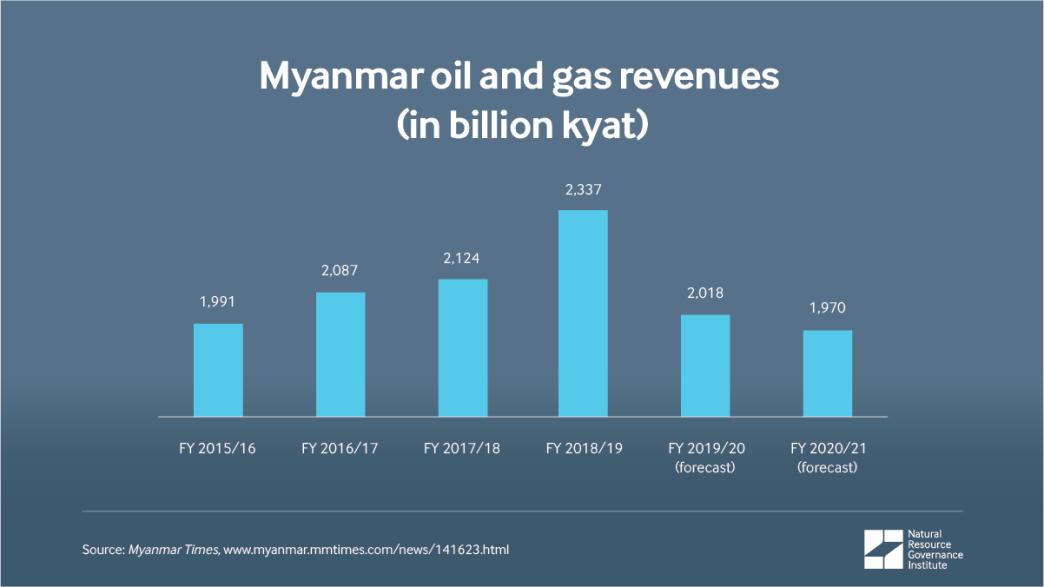

NRGI’s calculations, using Rystad Energy and IMF data, suggest there will be a 9 percent drop in Myanmar’s oil and gas revenues between January and December 2020, compared to 2019. The World Bank has predicted that lower international demand and gas prices will slash oil and gas revenues in FY 2020/2021 (October 2020 to September 2021) to about half their pre-pandemic levels. Declining volumes from Myanmar’s ageing gas fields will compound this. The Myanmar government projected a softer impact in terms of revenue decrease for FY 2020/2021, at a 2.4 percent drop. (See the graph below.) In all scenarios, Myanmar’s energy sector will continue to contract and add to the overall financial pressure on the economy, although the extent of this impact remains to be seen.

Myanmar also faces a serious challenge with the state-owned Myanma Oil and Gas Enterprise (MOGE). It was not commercially profitable even before the pandemic. Its expenditures are funded by the government, like other state-owned enterprises in Myanmar, while its income comes mainly from the tax it collects passively. The latest Myanmar citizen budget covering FY 2019/2020 predicted that MOGE will have an income of 2,018 trillion kyat ($1.5 billion) against an expenditure of 2,218 trillion kyat ($1.7 billion), suggesting a drain on the budget. In light of falling revenues and planned spending cuts for state-owned enterprises in FY 2020/2021, MOGE will likely borrow from its joint venture partners through cash calls or from state-owned banks to finance the deficit rather than addressing its fiscal inefficiency.

Mineral mining sector

As mentioned above, the pandemic had little impact on mining production. While prices of many widely traded minerals collapsed in March/April 2020, most metal prices rebounded during the second quarter of the year and are now above their pre-pandemic levels. Therefore, we expect little impact on the mineral sector earnings. However, as they make a relatively small contribution to government revenues, they will do little to ameliorate the impact of the coronavirus on overall extractive revenues.

Jade and gemstone sector

The coronavirus has effectively stopped state-owned Myanmar Gems Enterprise (MGE) from holding emporiums, which are the official forums for the sale of jade and gemstones. MGE data show that government earnings from emporium sales in 2020 are almost non-existent. MGE typically hosts multiple emporiums each year for domestic and international buyers, in Myanmar Kyat and in Euro respectively. Data from MGE show that emporiums held in euro typically generate higher-value sales and more government income compared to those held in Myanmar kyat. MGE has only been able to host one minor emporium in Myanmar Kyat in January 2020 and none in Euro. (Technically, the Myanmar government may count some of the emporium sales and income from FY 2018/2019 as part of FY 2019/2020 if the payments are delayed.)

Apart from the official sales (which represent a small fraction of the true value of jade and gems production due to smuggling of high-quality stones to China), unofficial sales are also likely to have fallen due to movement restrictions and China’s clampdown on irregular border crossings. In addition to a decline in sales, prices have also dropped. Recent media reports indicate that the price for officially traded commercial jade has fallen as much as 50 percent while reports suggest artisanal miners are getting a mere 10 to 20 percent of pre-pandemic prices.

Impact on natural resource governance issues

The pandemic and associated travel restrictions have impeded in-person engagement by civil society organizations (CSOs) on the resource governance agenda, both with each other and with government officials. In addition, reduced executive capacity due to a spike in coronavirus transmissions since August 2020 and the political dynamics in the aftermath of the November 2020 general elections means that there is less government bandwidth for resource governance issues at this time. We anticipate that progress across a number of reform issues will be delayed.

Looking forward

The outlook for Myanmar’s extractive sectors is uncertain. The National League for Democracy’s (NLD) landslide general election victory in November will have some bearing on the management of natural resources. The NLD will have its pick of ministers at the Ministry of Electricity and Energy and the Ministry of Natural Resources and Environmental Conservation, entities which will have significant influence over national policies. The opposition, including minority ethnic parties, now has fewer than expected seats to electorally represent their constituencies, many of which are resource rich. A few days after the election, the NLD sent an open letter to 48 ethnic parties seeking to work with them to realize a “federal democratic union,” indicating opportunities to contribute to policymaking, including in the governance of natural resources.

The pandemic has yet to lead to “fire sales” of natural resources in Myanmar. This is an encouraging sign indicating that the government is not relying on extraction to finance the budget needs arising from coronavirus. Planned oil and gas bidding rounds, as well as expected mineral, jade and gemstone concessions allocations, shouldn’t proceed in 2020 and 2021 without due oversight from the Ministry of Planning, Finance and Industry and the newly elected legislature.

Authorities must also properly sequence current legal frameworks—including the draft Petroleum Bill, the new oil and gas production sharing contract and the draft Gemstone Rules—and efforts to ensure that their provisions are clear and are used to inform the licensing and concession terms.

Progress on the following is key for the extractive sector and resource governance:

-

Myanmar SOE reforms are critical, including strengthening transparency, separating regulatory and commercial functions and addressing fiscal inefficiency.

- MOGE needs to more effectively prepare for a long-term decrease of oil and gas revenues as the world moves forward on energy transition to renewables.

-

MONREC should ensure that ongoing mineral and upcoming jade and gemstone decentralization is well-managed and well-coordinated among national and subnational authorities.

- Specifically, MGE should put in place remedial safeguards to ensure the Kachin State government, which has started to issue artisanal mining licenses before the Gemstone Rules are enacted, practices robust management of social and environmental impacts. In addition, it should coordinate with other subnational governments to ensure artisanal and small-scale licensing happens only after the Gemstone Rules are finalized. MGE should provide sufficient resources and expertise to subnational governments for effectively managing their new roles.

- Contract transparency is vital in Myanmar, given the importance of managing oil and gas revenues efficiently and the current lack of clarity among government and non-government oversight actors around contractual terms. The absence of contract disclosure makes it difficult to fully assess the risks.

- Civil society actors need more support to continue operations and not lose ground during this time. Myanmar’s government should establish mechanisms for consultation with civil society on its decision making.

Aye Kyithar Swe is the Myanmar interim country manager at the Natural Resource Governance Institute. Ko Ko Lwin is an NRGI analyst. Josephine van Zanten is an NRGI associate. Arkar Hein is a consultant to NRGI.

Authors

Aye Kyithar Swe

Chief of Staff