2021 Resource Governance Index: Lebanon (Oil and Gas)

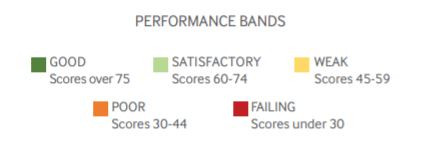

Assessed for the first time, Lebanon’s governance of its nascent oil and gas sector scored 53 out of 100 points in the 2021 Resource Governance Index. While Lebanon is not yet an oil and gas producer, its government has begun to establish an institutional framework to govern the sector before production begins. Lebanon received a “satisfactory” score of 73 points in terms of its ability to realize value from its sector according to the RGI, with the Lebanese Petroleum Administration (LPA) displaying signs of best practice in terms of extractive sector transparency. Nonetheless, “weak” revenue management and a “poor” enabling environment are causes for concern for the future of Lebanon’s resource governance.

Key messages:

- The legal frameworks governing the licensing process and social and environmental impacts show evidence of best practice. Authorities have disclosed contracts and environmental and social impact assessments.

- National budgeting merits attention, especially due to the absence of fiscal rules governing public spending, which the government of Lebanon should establish before production begins.

- Although rules and laws governing the sector are often in place, authorities do not always enforce them. A 17-point implementation gap highlights the need in Lebanon to ensure compliance and enforcement of existing and future laws and regulations.

- Lebanon’s poor enabling environment, an assessment of general governance, stems from “failing” scores in the corruption and political stability subcomponents, both of which threaten the future success of the governance of the oil and gas sector.

NRGI recommends the following courses of action for the improvement of oil and gas sector governance in Lebanon:

- Resource governance can only thrive if grounded in a strong overall governance system. This requires the Lebanese government and Lebanese Petroleum Administration, along with key policymakers and stakeholders, to work to build transparent and accountable systems that earn the trust of Lebanese citizens. If general governance deteriorates, the oil and gas sector may well suffer a similar fate.

- The government must include civil society organizations in consultations regarding the role that oil and gas can play in the Lebanese economy, and the future of energy systems in light of the climate crisis. Additionally, the government must be involved in and adhere to key initiatives, such as the Extractive Industries Transparency Initiative, to show its determination in building a more accountable system.

- Parliament and key ministries must strengthen public official asset disclosure and beneficial ownership disclosure requirements and must establish and implement robust auditing processes related to all institutions responsible for the oil and gas sector.

- The government must make good on its promise and establish and maintain an up-to-date registry of licenses.

- The Ministry of Finance should set numerical fiscal rules before oil and gas production begins to prevent poor, shortsighted fiscal management of resource revenues.

- When relevant, the LPA must ensure transparency regarding reserves, production, and exports, as a crucial step to pushing towards transparent and accountable management of the sector.

- The government should follow best practices in the creation and operationalization of a sovereign wealth fund by establishing a strong legal framework and ensuring that transparent and accountable practices prevent the siphoning of resource revenues or financial mismanagement.

The 2021 RGI assesses how 18 resource-rich countries govern their oil, gas and mineral wealth. The index composite score is made up of three components. Two measure key characteristics of the extractives sector – value realization and revenue management – and a third captures the broader context of governance — the enabling environment. These three overarching dimensions of governance consist of 14 subcomponents, which comprise 51 indicators, which are calculated by aggregating 136 questions. For more information on the index and how it was constructed, review the RGI Method Paper.