2021 Resource Governance Index: Qatar (Oil and Gas)

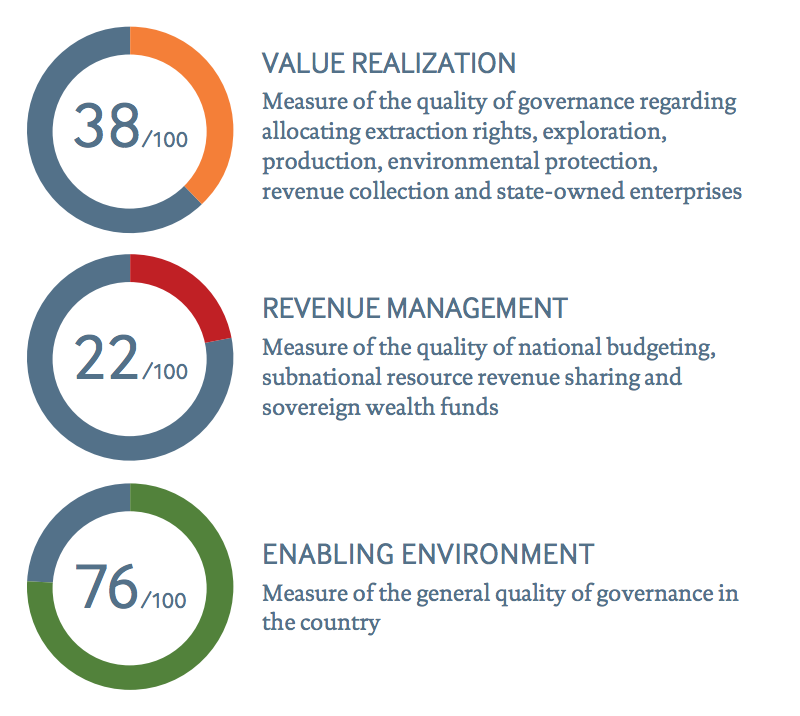

Qatar scored 45 out of 100 points in the 2021 Resource Governance Index (RGI), moving from the “poor” performance band to the lower end of the “weak” band. Positively, Qatar Petroleum (QP), the state-owned enterprise, achieved a 10-point increase since the 2017 RGI, moving into the “satisfactory” performance band. Nonetheless, significant areas of concern exist across the index’s value realization and revenue management components, with scores on the licensing, local impact and sovereign wealth fund subcomponents classified as “failing.”

- A lack of laws and disclosures related to licensing rounds and contracts pose significant problems to transparency and accountability in the Qatari oil and gas sector.

- Lack of laws and practices related to the disclosure of environmental impact assessments and mitigation plans resulted in Qatar’s failing score for governance of local impacts.

- The assessment reveals a lack of established fiscal rules regulating expenditures, which hinders long-term and sustainable spending strategies.

- Qatar Petroleum’s score improved since the 2017 RGI following enhanced production and joint venture and subsidiaries disclosures, but room remains for improvement in commodity sales rules and disclosures.

- The Qatar Investment Authority receives a failing score in every assessed category and remains one of the world’s most opaque sovereign wealth funds.

- The Qatari government should couple its positive steps towards transparency, such as the disclosure of winners of licensing rounds and the allocated areas, with firm rules and regulations establishing these practices in law, in order to avoid potential backsliding.

- The Qatari government should establish numerical fiscal rules governing annual spending of oil and gas revenues to safeguard the economy against rapidly fluctuating prices.

- The Qatari government and Qatar Petroleum should establish commodity sales rules and disclose these publicly to enhance transparency and accountability regarding oil and gas sales destinations and revenues.

- The Qatari government should establish a legal framework requiring the public disclosure of environmental impact assessments and mitigation plans. This is even more pressing in light of the accelerating climate crisis and the ongoing energy transition.

- The Qatari government and Qatar Investment Authority should adopt must be established governing all aspects of the sovereign wealth fund’s operations and investment. Firm laws on deposits, withdrawals and investments, are key to ensure stability during commodity fluctuations and to prevent mismanagement and opacity of investments. The Qatari government should follow Qatar Petroleum and join the EITI process to establish goals and account for improved governance in the oil and gas sector.

- The Qatari government must allow and create space for civil society to exercise oversight of the oil and gas sector if it is to improve transparency, accountability and resource governance.