2021 Resource Governance Index: Tunisia (Oil and Gas)

Français »

Key messages:

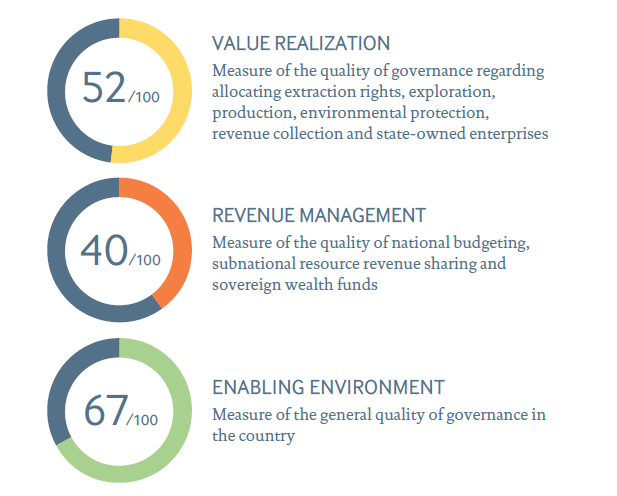

Governance of Tunisia’s oil and gas sector has scored 53 points in the 2021 Resource Governance Index (RGI), down by three points since the 2017 RGI. While the index’s revenue management and enabling environment stagnated, this decrease is driven by an eight-point deterioration in Tunisia’s ability to realize value from its oil and gas sector.

Key messages:

- Licensing scored “poor” due to a lack of disclosures regarding companies’ beneficial ownership and public officials’ financial interest information.

- The governance of environmental and social impacts scored “poor” due to a lack of environmental impact assessments and mitigation plan disclosures.

- State-owned enterprise ETAP demonstrated “satisfactory” governance standards, but areas of improvement remain, especially in the disclosure of commodity sales information.

- Issues related to Tunisia’s political instability hamper the chances of improvement of oil and gas governance.

NRGI recommends the following course of action to improve oil and gas governance in Tunisia:

- The Tunisian government should pass laws or amendments to the hydrocarbon code requiring the disclosure of contracts, biding lists, EIAs and environmental mitigation plans, and the commissioning and disclosure of SIAs by extractive companies. Open contracting principles could inspire the government in its licensing reform process.

- ETAP should improve its disclosures to include information on the buyers, value, volume and date of each transaction to offer civil society actors a better understanding of oil and gas revenues.

- The Ministry of Industry, Energy and Mines should revamp its online portal to include details on reserves and exports revenues.

- The government should implement a robust financial interest and beneficial ownership disclosure policy to enhance transparency in the sector.

- The government and Ministry of Finance should prioritize accession to the Extractive Industries Transparency Initiative, and commit to standards pushing for enhance disclosures, sustainability, inclusivity and efficiency.