Peru: Updated Assessment of the Impact of the Coronavirus Pandemic on the Extractive Sector and Resource Governance

This is one of a series of country briefings produced by NRGI to summarize the evolving situation with respect to the pandemic and its economic impacts. The analysis it contains is subject to change with circumstances, and may be updated in due course.

Key messages

- As 2020 ends, Peru faces deep economic and political crisis. Meanwhile coronavirus infection rates are slowing but a “second wave” is possible.

- Peru has suffered some of the world’s highest COVID-19 mortality rates, biggest drops in employment rates and gross domestic product (GDP), and most significant increases in poverty during 2020.

- Peru’s solid macroeconomic situation prior to the pandemic allowed its government to then take on significant debt to fund its USD 39 billion pandemic recovery plan at low interest rates.

- The crisis has affected Peru’s hydrocarbon sector more than its mining sector. Mineral production in the country recovered quickly, while oil production continues to fall.

- Civil society organizations in Peru are concerned about changes to the mining sector’s legal framework and announcements of upcoming reductions of environmental and social standards, especially related to consultation of indigenous people.

- In Peru’s hydrocarbon sector, companies are pushing for reductions in royalty rates and other measures to make investment more attractive. Changes in legislation could also include reduced social and environmental standards.

Despite adopting stringent lockdown measures early in the coronavirus outbreak, as 2020 comes to an end, Peru’s COVID-19 mortality rate is the third highest in the world, at 114 deaths per 100,000 people. While by the end of the year the health crisis seems to have become less critical, the country has descended into political crisis. On 9 November, the congress impeached then-president Martin Vizcarra and named congressional president Manuel Merino the nation’s interim president. Massive street demonstrations against Merino’s government followed his appointment. Polls showed that 90 percent of the population opposed the impeachment.

Demonstrations, which lasted over a week, were the largest the country had seen in decades and provoked police brutality, resulting in the killing of two young men and injury of over a hundred people. This in turn led to Merino’s resignation, leaving the country temporarily without a president, until the appointment by the congress of a new president, Francisco Sagasti. Despite a crisis resulting from the new government measures to reform the police forces, relative calm returned as the legislature gave the new cabinet a vote of confidence in early December.

This political crisis has taken place in advance of presidential elections due in April 2021. The political forces promoting the impeachment have been described as a “coalition of the corrupt,” and they are still actively passing controversial economic legislation and threatening the government’s stability.

Economic impact

The Peruvian government’s economic plan to address the pandemic emergency, one of the largest in the region, cost over USD 39 billion. It has two main components: measures to mitigate the health emergency, and measures to promote economic recovery. Data published by the Ministry of Finance show that 80 percent of the planned spending for economic recovery has already been assigned.

During 2020, Peru’s public debt increased from 26.8 percent of 2019 GDP to 35.4 percent. Most of the economic recovery plan this year was funded through debt, after the government withdrew almost all of the $5 billion savings from the Fiscal Stabilization Fund into the Treasury's account. Peru’s solid macroeconomic position meant that there was demand for government bonds throughout 2020 and rates were relatively low, including a sale in November of $4 billion in bonds with maturities of 101 years, with record low rates. For 2021, the approved budget implies a further increase in public debt from 35.4 percent to 38 percent of GDP.

The country’s GDP fell by 39.2 percent in April 2020 compared to 2019, and continued to fall after that although at a slower rate. The fall in GDP between January and September 2020, compared to the same period in 2019, was 15 percent. The Ministry of Finance estimates the annual decline in GDP in 2020 will be 12 percent, but is optimistic about a recovery in 2021, with a forecast 5 percent GDP increase next year.

Despite a positive credit rating and access to debt, the extent of Peru’s downfall in 2020 evidences the deep cracks in the “Peruvian economic miracle.” The health system was in a precarious position, while the informal nature of many Peruvians’ livelihoods meant many had to continue working despite the lockdown. Employment in the capital, Lima, was 69.2 percent lower in April 2020 than it was in April 2019. It continued to fall at a slower rates in subsequent months. The Economic and Social Commission for Latin America and the Caribbean (ECLAC), estimates that poverty in Peru increased from 16.5 percent in 2019 to 25.8 percent in 2020, and extreme poverty from 3.7 percent in to 7.6 percent, one of the highest increases in the region.

Impact on the mining sector

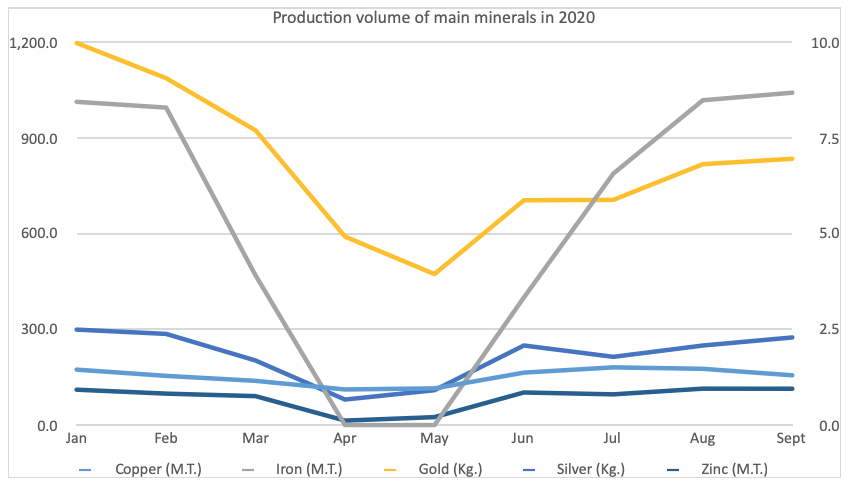

Although the government defined mining as a priority sector and allowed it to continue operating during the lockdown, most mining companies halted or restricted their operations due to health concerns, logistical limitations and social resistance, causing a sharp fall in production in March and April. However, companies swiftly returned to their regular operations, and by July 90 percent of companies were back to full production. By September, as shown in the chart below, production of the country’s main minerals was mostly back to pre-pandemic levels.

Source: Central Bank (Banco Central de Reserva del Perú – BCRP), Weekly Note (Nota Semanal) December 10, 2020.

Gold volumes are shown in the right axis, other minerals in the left axis.

Click to enlarge

Still, between January and September 2020, production for the certain minerals was lower than the previous year. For instance, copper production decreased 16.6 percent while gold production fell by 35.4 percent compared to 2019.

Mineral exports have been recovering slowly since May, after a sharp fall in April of 57 percent compared to April of 2019. Exports have not yet reached pre-pandemic levels, and in both August and September exports contracted once more, suggesting recovery of export revenues will take some time. This has also impacted tax revenues: between January and October 2020, tax revenues from mining were 32.4 percent lower than the same period of 2019.

In sum, the mining sector’s operations and production have made a quick comeback. However, the effects of the pandemic have been strong and are visible in its export and tax revenue levels. Prospects for 2021 seem positive with new five new mining projects beginning construction next year and two beginning the production phase. Furthermore, as international prices and demand recover, exports and company profits could return to normal in 2021.

While at the national level the mining sector seems to be overcoming the effect of the pandemic, the fallout from this year will continue into 2021 for producing areas. Mining revenue transfers, locally called “mining canon,” are made up of 50 percent of the previous year’s income tax payments. This means that while transfers to the regional governments were high in 2020, they will drop in a delayed reaction to the crisis in 2021. The specific transfers to each region depend on the results of the company or companies operating there.

A company-by-company analysis carried out by Grupo Propuesta Ciudadana (GPC), using data from publicly listed companies, sheds some light on specific cases. For instance, for the southern region of Arequipa, where the main mining project is the copper extraction by Cerro Verde, the effects of halting production have been dramatic: a 98 percent drop in profits in the first semester of 2020, which means significantly lower canon transfers for the region. Meanwhile, Southern Copper Corporation’s profits were only 15 percent lower in the first half of 2020, compared to 2019, which means the drop in transfers to the Moquegua and Tacna regions where it operates will not be as extreme. GPC estimates that the fall in mining transfers in 2021 will be 33 percent on average across producing regions.

Impact on the hydrocarbon sector

Peru produces both oil and gas on the northern coast, offshore and in the Amazon region. As in the case of mining, hydrocarbon operations were legally allowed to continue during lockdown, but most companies halted or reduced their production due to health concerns, logistical disruptions and social resistance.

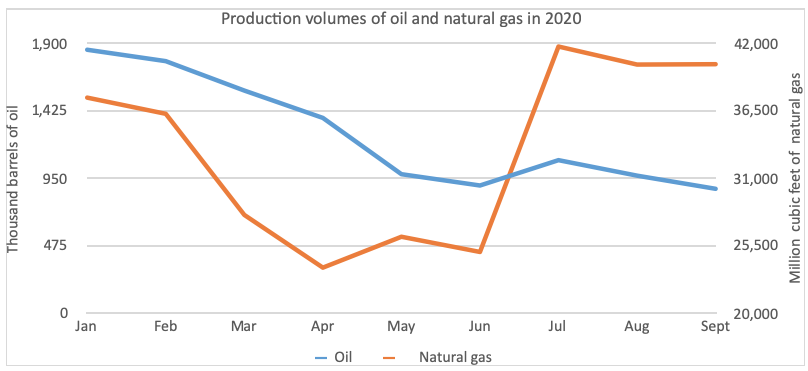

What has made the pandemic’s impact on oil greater is the steeper fall of international demand and prices, and the slower recovery of prices and national production. In fact, gas production surpassed pre-pandemic levels in July, while at the end of 2020 oil production continues to fall. Compared to the same period in 2019, oil and gas production in January to September 2020 fell by 50.7 percent and 13.6 percent respectively. Additionally, 15 of the 26 ongoing projects have claimed force majeure; most were exploration contracts. Companies have not drilled any new wells in the second half of the year. This means that investment in new projects in the sector has collapsed.

Hydrocarbon exports between January and September of 2020 have also fallen significantly compared to prior year. The value of oil exports decreased by 59 percent, while the value of gas exports fell by 33.6 percent. Finally, tax revenues fell by 43.1 percent from 2019, while royalty payments, which are more economically significant for the sector, fell by 51 percent from 2019 levels.

As with mining, subnational governments in producing regions receive transfers of a portion of royalties. Therefore, their revenue has decreased, with oil producing regions facing the harshest declines. For instance, in the Loreto region, which produces one third of the country’s oil output, oil revenue transfers between January and October were 51 percent below the same period in 2019.

Source: Central Bank (Banco Central de Reserva del Perú – BCRP), Weekly Note (Nota Semanal) December 10, 2020.

Click to enlarge

Against this backdrop, Perupetro, the industry regulator, announced in July that it would proceed with bidding rounds for eight oil projects whose contracts will end soon (the first in December 2021). Royalty rates are part of the contract terms for each project. Therefore, if negotiations take place during the pandemic, with low oil prices and an uncertain outlook, it is likely that royalty rates will be low and remain that way even if the sector recovers in the near future.

Representatives of the association of mining and hydrocarbon companies have stated that they have discussed with Perupetro modifications to the legal framework on royalties. They also argued for a change in the conditions to promote investment in the oil sector to overcome the crisis, including “eliminating bureaucratic barriers and reducing social conflicts.”

The Ministry of Mines and Hydrocarbons has announced that it was working on a new hydrocarbons law, which could include changes to promote investments. Congress debated a previous draft law in 2018, but did not approve it over concerns regarding the increased duration of contracts and the assignment of supervision of environmental impacts.

Impact on natural resource governance

There has been a strong message from both government and companies that the only way out of the slump for Peru is to promote more mining investment. Proponents of this theory suggest that the government ought to adjust the legal framework to facilitate and promote investment in mining and hydrocarbons.

In the mining sector, there have been many changes in rules and regulations—some of them directly related to the pandemic, aiming to adjust procedures for social distancing and restrictions to movement. For instance, Decree 1500 allows virtual citizen participation meetings, exempts companies from the requirement to present social and environmental monitoring reports based on fieldwork, and postpones payments for environmental sanctions. Ministerial Resolution Nº128-2020-MINEM established the health protocols for mining, including the number of workers allowed in a determined area and safety guidelines. Supreme Decree Nº024-2020-EM established the guidelines for mining beneficiation licenses during the health emergency.

Some changes have gone beyond the pandemic and follow a previous trend to “simplify” requirements and procedures prior to exploration, including environmental evaluations and social standards such as consultation. Among these changes are Supreme Decrees 019-2020-EM and 020-2020-EM that modify the environmental protection regulations for mining exploration activities and the general regulations for mining procedures. Among the changes in these decrees was the approval of a specific environmental permit (ficha técnica ambiental). If there is no ruling from the regulator in a defined period of time, the permit is considered approved. Mining companies have been requesting this modification in recent months.

Several civil society organizations have argued that these changes are not a simplification of procedures, but are in fact a lowering and weakening of social and environmental standards.

Combined, these measures indicate that Peru is engaging in a “race to the bottom” in extractives’ governance. At the same time, private sector players opposed the Escazú agreement, a measure that would have increased safeguards to environmental defenders, and strengthened environmental standards and transparency. The Constitutional Court ruled out a claim of unconstitutionality of such race-to-the-bottom policies in 2014 when the government cut the faculties of the environmental protection agency, OEFA, in a similar context.

In addition, back in June, the minister of economy stated that she would implement a virtual process of prior consultation for the San Gabriel mine in the Moquegua region. Indigenous organizations issued a statement expressing their opposition and arguing that this form of consultation “does not allow an intercultural dialogue in conditions of equality.” The minister of energy and mines then discarded this option, but representatives of the mining companies insisted on the relevance of the measure.

More recently, the current minister of energy and mines, appointed in November by President Sagasti, announced that modifications in rules were coming for simplified and shorter processes for indigenous consultation for mining exploration. Members of congress have also attempted to pass laws that weaken environmental and social standards in the mining sector, and could continue to do so until the end of their tenure.

Civil society organizations are concerned that these and other legal changes will lower environmental standards or diminish indigenous peoples’ rights to participate in decisions that affect their lands.

Looking forward

At the close of 2020, uncertainty continues. Although the contagion appears to be under control, there is still a possibility of a second wave of the pandemic, as is happening now in many countries such as neighboring Chile. This could come alongside a precarious political situation, deep economic crisis, upcoming elections and a La Niña meteorological event which may trigger natural disasters throughout 2021.

In the Peru’s sector, civil society organizations should continue to meticulously monitor and analyze proposals, draft laws and norm changes to identify dangers and thus prevent a further race to the bottom. The issue of consultation has come up frequently; therefore, civil society actors must promote an informed debate about proposed changes to consultation with citizens.

Social conflict around mining is also increasing. Claims around unfair labor conditions are a source of conflict, which has led to a general strike of the National Mining Workers Federation in December. A further cause of conflict is the lack of economic benefits for local populations during the initial years of extraction, when companies are not yet paying income tax (e.g., the case of the Las Bambas copper mine in Apurimac). These conflicts, as well as those around new projects and fear of environmental impacts, will likely increase as the government continues to promote investment in this sector.

One legal change that could be relevant and will require thorough review relates to rules for uranium extraction. The country’s only known lithium reserve includes uranium. Therefore, enactment of new rules could renew interest in lithium extraction, currently stalled due to problems in the exploration phase as well as the pandemic. Lithium extraction could become significant for Peru given the expected increase in demand in the medium term, driven by the global energy transition’s need for battery metals.

In the hydrocarbons sector, discussion will likely revolve around changes in the rules regarding royalty rates, as well as bidding processes for contracts that are about to expire. Although it is unlikely that the current congress, which only has seven months left, will debate a new draft of the Hydrocarbons Law, civil society should monitor any proposals that arise and their implications for a further race to the bottom.

For both sectors, declines in revenue transfers will be a significant issue and possibly a source of conflict.

Moreover, discussions and changes will take place during a period of election campaigns, in which economic recovery will likely be a priority; the role of mining and hydrocarbons in this recovery will be an important topic. This context can be an opportunity to counter the prevailing narrative with a clear message that recovery cannot come at the expense of social standards and environmental safeguards.

Claudia Viale is a Latin America senior officer at the Natural Resource Governance Institute (NRGI).

Authors

Claudia Viale

Latin America Senior Officer