Revenue Sharing Case Study: Oil and Gas Revenue Sharing in Bolivia

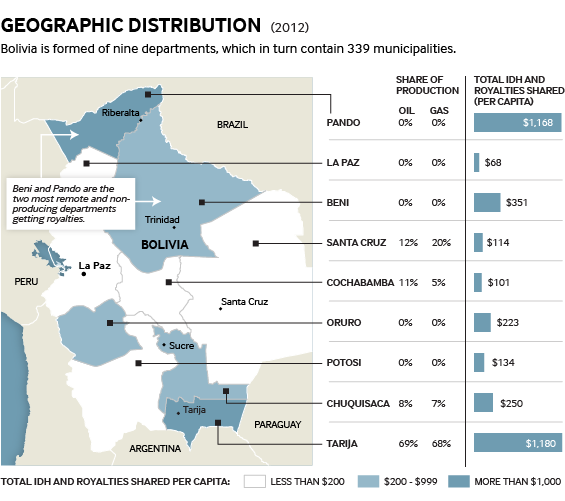

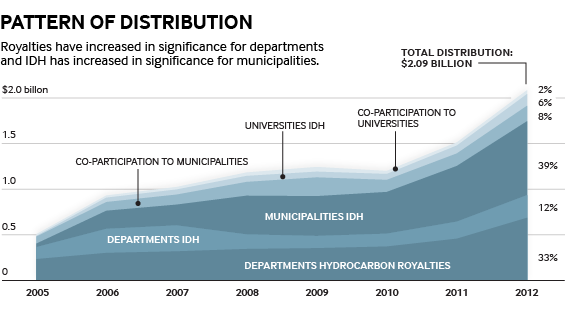

This study provides an overview of natural resource-related intergovernmental transfers in Bolivia—that is, the revenue that the Bolivian national government earns from extraction and then redistributes to subnational authorities.

While the primary focus is on transfers of revenue from oil and gas, the study also provides some information on transfers from mining and forestry, as well as the revenue from the general tax regime, which is known in Bolivia as “fiscal co-participation.” This study outlines fiscal decentralization and the evolution of revenue sharing, and provides an overview of how resource revenues are collected and then shared with subnational authorities within the country’s wider intergovernmental transfer system.

The case study and related infographic provide information on any statutory earmarks of revenue, the level of transparency surrounding the revenue sharing system and the effectiveness of the system when this can be determined. This paper is primarily intended to inform policy debates on revenue sharing in Bolivia and other countries as well as researchers interested in further exploring key issues related to this topic. It forms part of a broader set of case studies on revenue sharing.