Transfer Pricing in the Extractive Sector in Ghana

Like many countries in West Africa, Ghana has abundant mineral and petroleum resources, making the extractive industry a vital source of government revenue. According to the Ghana Extractive Industries Transparency Initiative (GHEITI), the mining sector alone contributed 10 percent to gross domestic product (GDP) in 2013, and oil and mining together accounted for 66 percent of exports. Despite the significant contribution of the extractive sector to Ghana’s economic growth, allegations of potential tax avoidance suggest that extractive industry revenues could be far higher. The discrepancy is due to transfer mispricing, trade mis-invoicing, and thin capitalization. Ghana ranked 93rd of 145 developing countries in terms of illicit financial flows in 2013.1 Recognizing the risk that tax avoidance poses to the extractive industry tax base, the government has adopted appropriate legal measures, however challenges persist in the area of implementation and enforcement.

To address these issues, Ghana has sought to introduce transfer pricing rules. Transfer pricing is the mechanism by which prices are chosen to value transactions between related legal entities within the same multinational enterprise (MNE). These are referred to as “controlled transactions” and may include the purchase and sale of goods or intangible assets, the provision of services, the provision of financing, cost allocation, and cost sharing agreements. In principle, this works when the price that is set matches the “arm’s length” price at which a transaction would have taken place between unrelated parties. However, transfer pricing may become abusive or illegal when related parties seek to distort the price as a means of reducing their overall tax bill. In these instances the practice may be referred to as “transfer mispricing.”

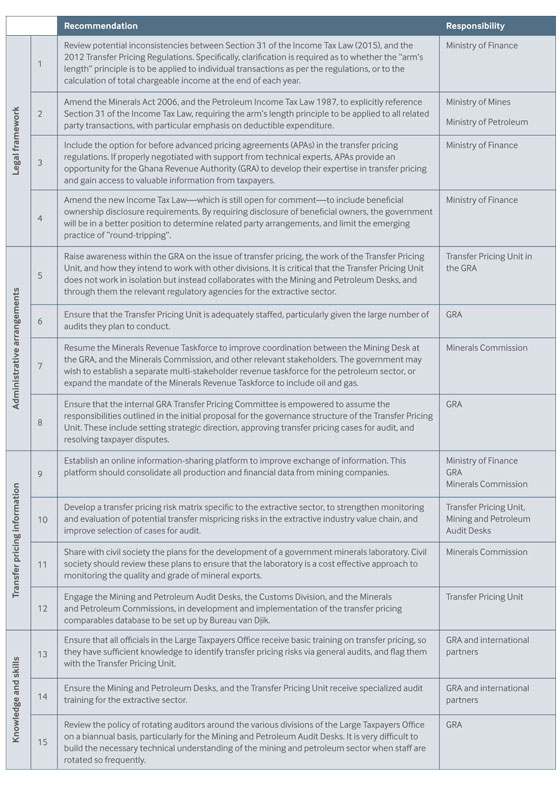

This case study investigates the barriers to implementation of transfer pricing rules in the extractive sector in Ghana.