G7 Countries Cannot Secure Critical Minerals Without Tackling Governance and Corruption

As the leaders of major world economies gather at the G7 summit this week, they will focus on turning the corner on the pandemic and pursuing a green recovery. For the U.S., EU and U.K., achieving this will involve honing strategies around supply of “critical minerals” such as cobalt and lithium needed for cleaner technologies like electric vehicles. Just today, the White House released a report on supply chain resilience with a focus on expanding critical minerals production, particularly domestically. Critical minerals will likely be high on the section of the G7 agenda around economic resilience of the global economy, especially given the interplay with geopolitical tensions with China and concerns that the U.K., this year’s G7 host, is lagging in the race for these crucial commodities.

Earlier this year, much was made of the U.S. re-blacklisting controversial mining magnate Dan Gertler over alleged corruption in the Democratic Republic of Congo (DRC), where Gertler’s companies control royalty streams from three of the world’s biggest cobalt projects. Gertler’s is not the only case of suspected corruption in the mining sector, yet governance and corruption are barely on the agenda when it comes to the white-hot topic of clean technology supply chains. If the G7 countries ignore mineral governance and corruption risks, they will be unable to secure reliable supplies; they also diminish the potential for citizens of producer countries to benefit from the extraction of these minerals.

As demand rises, consumer countries cannot just rely on mining “closer to home”

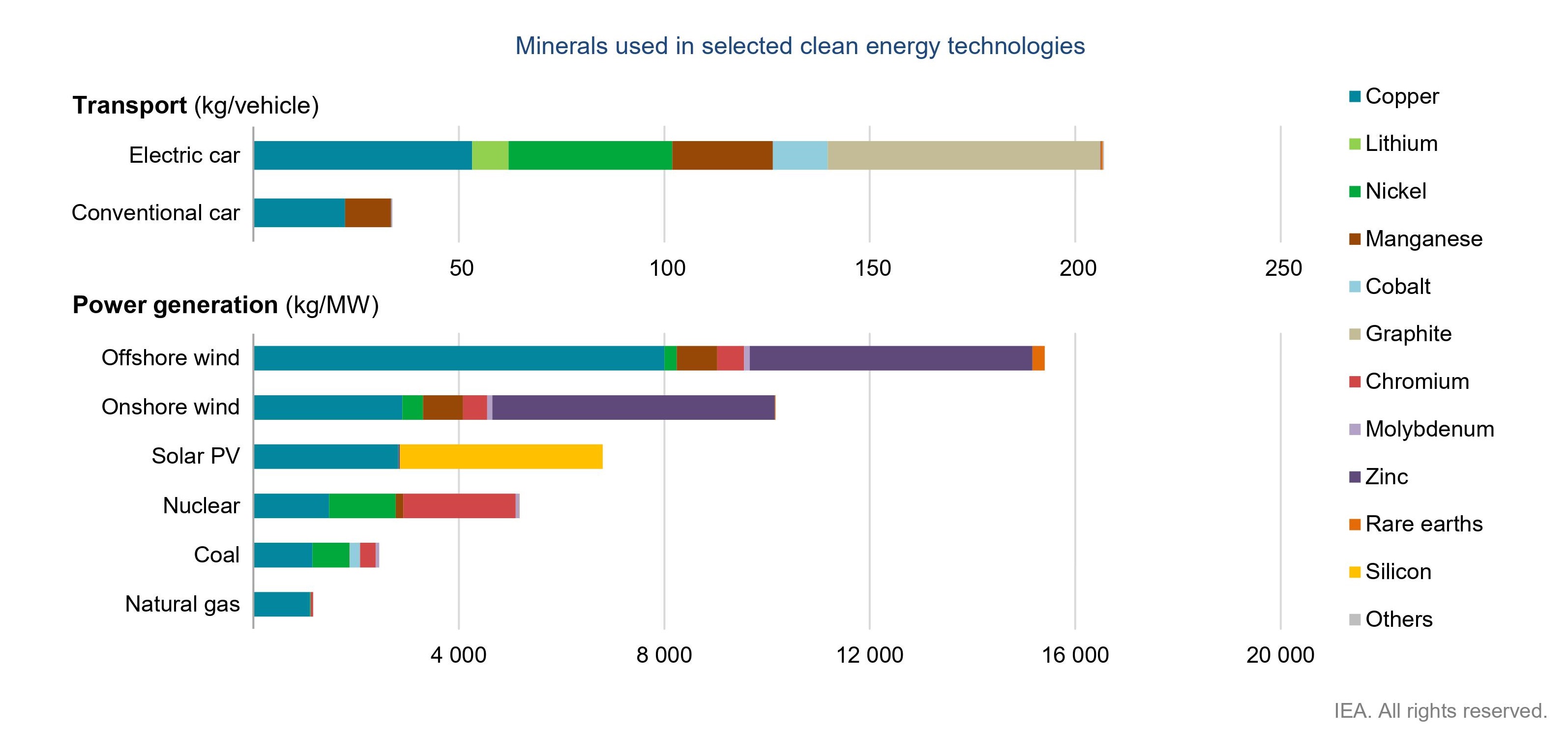

The need for greater quantities of clean technology minerals is ever more apparent. A recent IEA report underscored that cleaner transportation and power generation technologies use significantly more critical minerals than existing technologies. How this trend will shape the market remains difficult to predict. Supply sources can change as price increases entice new entrants, and demand can evolve as companies use alternative technologies and fewer (or recycled) minerals.

Minerals used in selected clean energy technologies

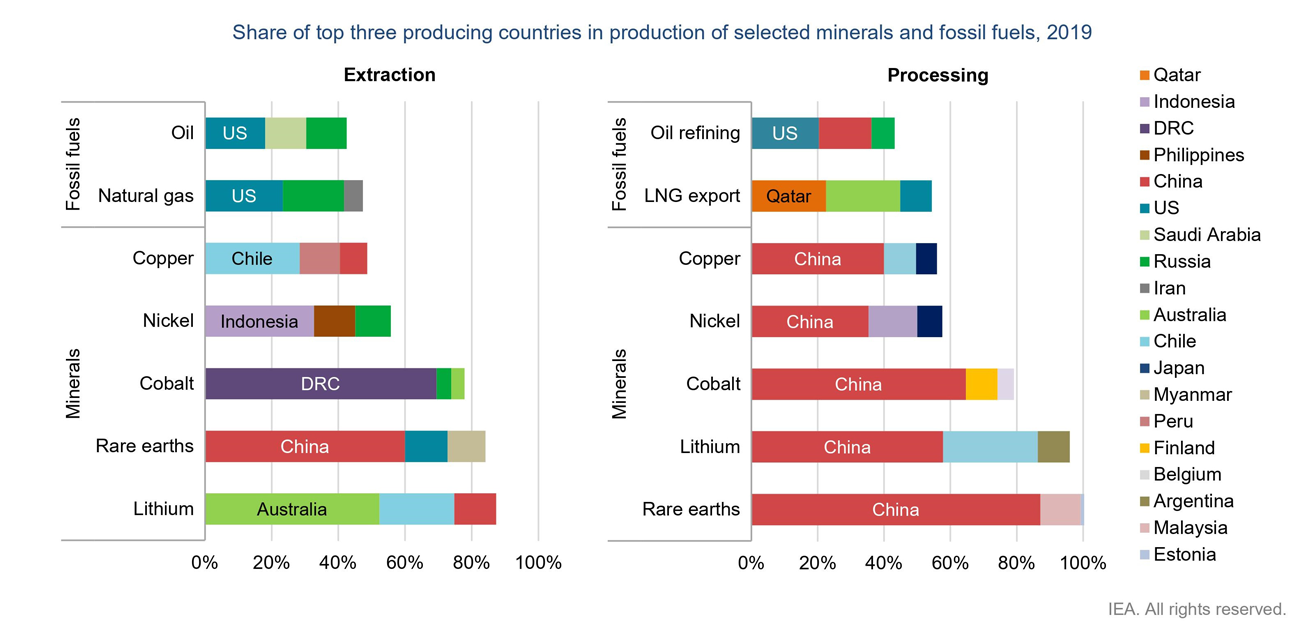

As G7 countries unveil climate commitments that rely on battery and other clean technologies, securing critical mineral supplies has shot up the policy agenda, with major consumers such as the U.S. and the EU focusing on securing supplies closer to home. As the Biden administration recognizes, these efforts are unlikely to suffice, given the geographical concentration of resources and the magnitude of mineral requirements in the clean energy transition.

Share of top three producing countries in production of selected minerals and fossil fuels, 2019

Developing countries and emerging markets will likely remain important suppliers for the foreseeable future given the predicted increase in critical mineral demand and likely opposition to more mining in places like Europe. The IEA finds that high reliance on the DRC for cobalt (the DRC is currently responsible for around 70 percent of global production) is set to persist. For copper, expanding supply will likely require growing production in places such as DRC, Indonesia, Mongolia and Peru.

Major consumer countries should invest in improved mining governance in critical mineral producer countries

In many countries with large critical mineral deposits, mining sector governance remains weak, vulnerable to corruption and tied to concerns around political instability. These challenges are neither new nor easily overcome. But they are an essential part of the critical mineral supply puzzle, and therefore essential to achieving the G7’s economic resilience and energy transition objectives. Without effective policies and well-governed institutions in major producer countries, effective scale-up and stable supply will be elusive.

The DRC, the world’s largest cobalt producer and a major supplier of copper, must improve the fundamentals of mining governance. This includes granting mining projects to efficient and qualified companies (rather than well-connected cronies) and addressing the challenges of artisanal and small-scale mining that represents 15 to 30 percent of Congolese cobalt production. For countries such as Bolivia, with its huge undeveloped lithium deposits, a strong government understanding of where economic opportunities lie is essential. Otherwise, governments risk chasing rainbows, such as insisting on sometimes infeasible in-country processing of raw commodities, thereby delaying and disrupting projects without increasing benefits for citizens.

As demand for critical minerals increases, two possible scenarios emerge for mineral-rich developing countries. The first is an acceleration of corruption, political instability and resource dependency of the kind associated with previous commodity booms—especially in oil—and a governance “race to the bottom,” where host countries compromise on standards and fiscal terms as consumer countries clamour to capture market share. This path is a minefield for Western companies as well as producer countries. In the second scenario producer countries mature their mining sectors to meet the demand, with the proceeds contributing to (rather than undermining) their stability and economic wellbeing.

To make this second scenario more likely, leading consumer economies including G7 members should provide increased support and technical assistance to producer country governments seeking to improve sector laws, institutions and practices, and prioritize transparency, accountability and anticorruption within these programs. G7 governments could establish a trust fund for concerted investment in capacity development and accountability, including support for industry regulators, anticorruption actors and civil society players. The U.S.-led Energy Resource Governance Initiative (ERGI), which engages developing country producers, as well as the UN could be other key influencers.

G7 countries should also prioritize governance in their mineral supply chain initiatives. Unfortunately multilateral discussions of the issue have barely touched on better resource governance in producer countries. Efforts such as the OECD’s Due Diligence Guidance and public-private partnerships such as the Global Battery Alliance are laudable, but they tend to focus on tracking and certifying where mineral flows originate, stemming from very valid concerns around connections to child labor and conflict. They lack focus on governance problems (though a recent OECD report on corruption risks is a promising start). Discussions on transparency in critical minerals, including in the IEA report, have focused on market transparency (e.g., greater information on reserves, demand, processing capacity and pricing) and technological solutions such as blockchain. These are important, but miss some of the more glaring governance threats to stable supply.

The governments and companies leading supply chain initiatives must advance forward-looking anticorruption and governance standards. Such measures should prominently feature in standards such as the OECD guidance, legislation in the European Union and other consumer jurisdictions, new systems in producer countries, and the policies of mining and battery companies and sector investors. Such measures include:

- Disclosure of the identities of beneficial owners of companies participating in the critical mineral supply chain, to reduce the risks posed by politically exposed persons and other inappropriate players.

- Disclosure of mineral contracts/licenses and payments, to support public oversight.

- Stronger company anticorruption policies, with robust measures for assessing corruption risks, avoiding high-risk third parties and responding to wrongdoing.

- Producing country commitments such as audits of state-owned mining companies, competitive tenders for major procurement, and transparent licensing and commodity-trading regimes.

By prioritizing this agenda, G7 countries and others can shore up critical mineral supply chains in ways that advance their energy transition and economic resilience objectives while also reinforcing their broader commitments to good governance, anti-corruption and financing development.

Amir Shafaie is the legal and economic programs director at the Natural Resource Governance Institute (NRGI). Alexandra Gillies is an advisor at NRGI and the author of Crude Intentions: How Oil Corruption Contaminates the World. Patrick Heller is an advisor at NRGI and a senior visiting fellow at the Center for Law, Energy & the Environment, University of California, Berkeley.

Authors

Alexandra Gillies

Contributor

Amir Shafaie

Legal and Economic Programs Director

Patrick Heller

Chief Program Officer