New Guide Simplifies Extractives Company Tax Payment Analysis

Last week, participants in Natural Resources for Sustainable Development—a massive open online course from NRGI, the Columbia Center for Sustainable Investment and the World Bank that is still open to learners—were studying extractive industry taxation.

They discussed very relevant questions for resource-producing countries: Which extractive projects represent fair deals for countries? Are mineral royalties an effective tool to capture economic rent? Do countries get more revenues from production sharing contracts or other contractual arrangements? Do companies really pay their fair share of income tax? Why do multinational companies use tax havens? And at what cost?

The only way to begin to provide answers to these questions is to analyze a wide array of economic data on these projects, in particular the actual payments which oil, gas and mining companies make to governments in order to extract those resources. Global Witness and Resources for Development Consulting have just published Finding the Missing Millions, a handbook that describes how to analyze and monitor this payments data.

In the past few years, the oil, gas and mining sectors have seen tangible transparency gains. Payments made by companies to governments in a growing number of resource-rich countries are now accessible to anyone. Thanks to legislation in Canada and Europe, multinationals are now required to report their project-level payments to governments. Even more data is accessible in countries implementing the Extractive Industries Transparency Initiative.

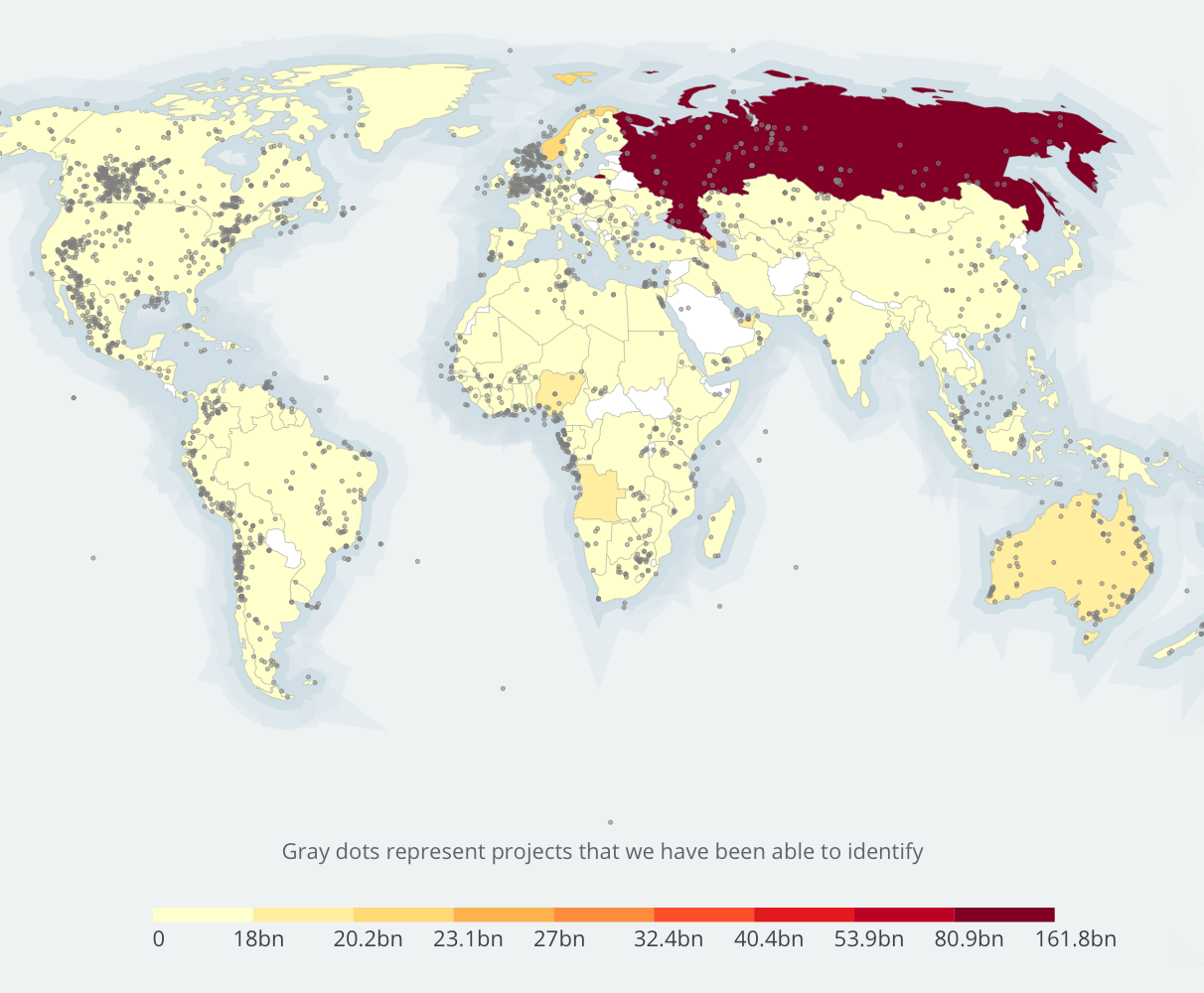

Total mandatory disclosure payments, 2015-1017.

Source: www.resourceprojects.org

Equipped with the new data, a growing community of civil society activists has studied various techniques to monitor and hold companies and governments accountable for payments received. Our colleagues at NRGI have used payments data to identify Nigeria oil management issues or gold mines’ state dividends receipts in Ghana. In a study on Ghana’s first giant oil field, we showed how the absence of ring-fencing provisions in the law allowed companies to defer corporate tax payments by many years. Other organizations have focused on payments from French companies in Africa or to sanctioned companies in the Democratic Republic of Congo.

But analyzing payment data should not be limited to specialist organizations focused on the extractives. Whoever feels concerned about what oil, gas and mining companies pay in taxes should be encouraged to look at the data themselves.

Finding the Missing Millions is a great resource for anyone interested in transparency and accountability in extractives taxation. It shows 10 different tests ranging in complexity and touching on various project and payment types.

With its step-by-step approach, examples and video tutorials, it is a highly accessible tool for those who may not yet have expertise in the economics of taxation but are interested in investigative techniques. Just pick your mine and go through the relevant test.

It is also a great resource for mining tax professionals and government policy-makers—it can be used as a starting point to assess fiscal regime effectiveness and compare countries’ revenue collection methods.

Researchers might be interested to run the various tests on payment data across a range of projects. While we expect discrepancies between the values estimated by the test and reported actual payments, systematic deviations in one direction may provide tentative evidence there is something wrong with our models.

NRGI’s team is excited by the prospects of more and more uses of payments to government data, and we encourage others to explore available data. To make the exercise of accessing this data easier, we have developed a portal called ResourceProjects.org, which collects reports from multiple sources and standardizes the data.

At NRGI’s advanced course on resource governance and in other country specific trainings, we have used techniques described in the handbook to teach participants how they can better use publicly available information in their analyses and investigations.

We remain realistic about what payment data alone can show. A key lesson from the handbook: we need to temper our ambition about getting from transparency to fair mining taxation with realism. Extractive industries can be complex. In any project-level analysis, there can be a multitude of explanations for any red flag identified, not all as bad as mismanagement or corruption. In the handbook’s examples, further investigation and company responses generally provided some credible explanation on the discrepancies found by the authors.

We encourage the rigorous analysis of extractive industry payment data, and remain available to support researchers and organizations in doing so. Feel free to drop us an email or a tweet!

David Mihalyi and Thomas Lassourd are senior economic analysts at the Natural Resource Governance Institute (NRGI).