Is Peru Losing Out on Gold Exports?

Reports such as Global Financial Integrity’s “Illicit Financial Flows from Developing Countries” have established that potentially vast amounts of capital leave developing countries unrecorded, largely through misinvoicing of commodity exports. We decided to investigate a particular case of this phenomenon: whether gold mining companies in Peru were exporting their production at a discount and evading taxes and royalties in the country.

While a superficial look at customs data might lead one to think that such illicit maneuvers were happening, our investigation found out that it was not the case. The recent debates around the methodology and the conclusions of the Trade Misinvoicing in Primary Commodities in Developing Countries UNCTAD report have shown that academics can be misguided by customs data on commodities. We think our step-by-step methodology could be useful to other researchers.

We focused our investigation on the two biggest gold mines in Peru, Yanacocha and Lagunas Norte. (Yanacocha is 51.35 percent owned by Newmont, 43.65 percent owned by Buenaventura and 5 percent owned by the International Finance Corporation; Barrick wholly owns Lagunas Norte.) They accounted for around 31 percent of the country’s total gold production in 2015, down from 66 percent in 2005.

A first look at customs data from SUNAT (Peruvian Customs Administration) and the U.N. COMTRADE database (using the commodity code for commercial gold HS 710812: Gold in Other Unwrought Forms) showed that during the same period the price of gold per troy ounce exported by these two mines was much lower than the “London fixing,” as the international benchmark price for gold is known. Switzerland was the main destination for these exports: the Yanacocha joint venture and Lagunas Norte represented 56 percent of total yellow metal exports from Peru to the country between 2005 to 2015. We then used Swiss Customs Administration data to confirm that gold from Yanacocha and Barrick also entered Switzerland below market prices. Figure 1 shows that other gold producers in Peru exported their gold at an average price that was much closer to international prices.

Figure 1

Source: SUNAT, BCRP (Central Bank of Peru).

This difference in prices led some analysts to suspect that Yanacocha and Barrick intentionally undervalued their gold sales to Switzerland in order to re-export the precious metal to other countries at “normal” international prices, transferring profits from Peru to Switzerland and other lower-tax jurisdictions.

We continued our investigation and interviewed experts from the Peruvian Ministry of Energy and Mines. They told us that Peru exported gold in two forms: doré bars and refined gold.

A doré bar is a semipure alloy of gold and silver, usually created at the mine site. These bars typically contain about 80 percent pure gold, but sometimes as little as 35 percent. The doré bars are then sent to a refinery, where they are refined into gold of different forms and purity. What we call refined gold is at least 99.5 percent pure gold. Yanacocha and Barrick export doré bars. The other producers export refined gold.

A limitation of the customs databases is that all refined gold and all doré bars are considered to be gold and are similarly coded as HS 710812 even if they have different proportions of gold and silver and, therefore, very different commercial value.

As a result, we considered the proportion of gold and silver in doré bar export data in order to assess the total price of Peruvian gold in exports (HS 710812) statistics.

We found the data for Barrick and Yanacocha’s gold production in the companies’ reports, but not their silver production. Fortunately, this proportion is mentioned in detail in Peruvian Ministry of Energy and Mines statistics.

Our results for Yanacocha and Barrick Gold are very similar and both can be downloaded here.

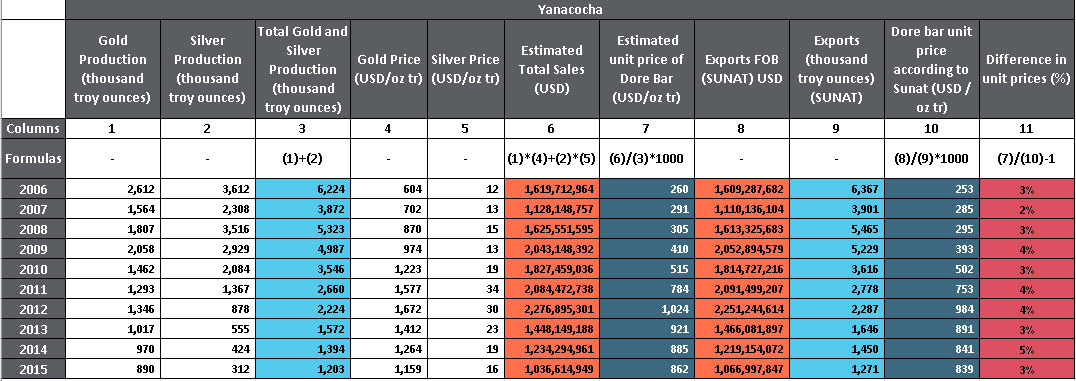

In column 6, we estimated total sales (in U.S. dollars) valuing the production of gold and silver (columns 1 and 2) at their respective international prices (columns 4 and 5). In column 7, we divided the total value of production by the total annual production, estimating the price of the average doré bar. Column 8, 9 and 10 show SUNAT official data for the value, volume and price of gold (doré) Yanacocha exports.

We found that our estimates of total export sales (Column 6) and doré bar unit prices (Column 7) were very similar to SUNAT data (Column 8 and 10 respectively). Small differences between columns 7 and 10 (3 to 5 percent, in column 11) can be attributed to price differentials and export registration date lags.

We concluded that Yanacocha and Barrick had not mispriced their gold exports from Peru. The apparent mispricing disappears once gold and silver in the doré bar are taken in consideration. The risk of confusion stems from the use of a single HS 710812 code to designate both refined gold (99.5 percent and more) and doré bars of different gold concentration.

From this experience, we developed a set of recommendations:

- Other researchers using customs data to try and identify mispricing of commodity exports should take into account how the different commodities are coded, and, in particular, the varying levels of quality within a single product code.

- Gold mining companies should improve reporting by including silver production and sales, and the composition of doré exports.

- Governments and custom authorities should follow SUNAT’s example and disaggregate gold and other commodities in export databases by type of products, so that the value commodities that share the same code can be compared.

Humberto Campodónico is a professor of economics, research associate at the South Center and advisory board member of the Natural Resource Governance Institute. César Carrera is an economist currently working at the Peruvian Ministry of Education.