Why Revenue Management Matters in Azerbaijan

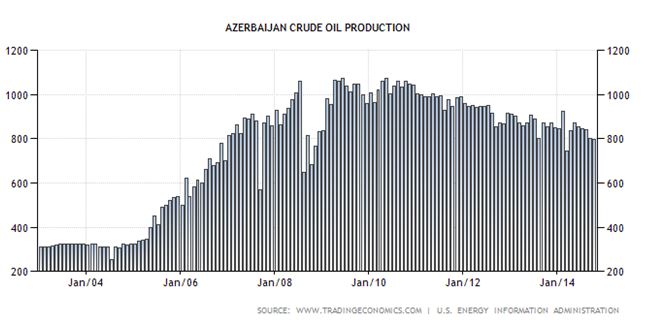

Oil production in Azerbaijan increased rapidly in the 2000s and the country reached peak oil production in 2010, when 363 million barrels of oil were produced. Then, production declined to 310 million barrels in 2012.

Large amounts of revenues accumulated in the state oil fund were spent through the state budget, which made the country’s economy and budget very sensitive to the price of oil. For the last four-to-five years state oil fund SOFAZ spent almost all its income, making the country’s budget even more dependent on resource revenues.

| Years | Transfers from SOFAZ to the state budget (million AZN) | Growth rate | Share of the state budget | Percentage of SOFAZ expenditures going to state budget |

|

2003 |

100 |

-- |

8.2% |

41% |

|

2004 |

130 |

30.0% |

8.6% |

77% |

|

2005 |

150 |

15.4% |

7.2% |

70% |

|

2006 |

585 |

290.0% |

15.6% |

59.6% |

|

2007 |

585 |

0.0% |

9.7% |

55.1% |

|

2008 |

1100 |

88.0% |

35.3% |

88.5% |

|

2009 |

4915 |

346.8% |

40.4% |

92.8% |

|

2010 |

5915 |

20.3% |

51.4% |

90.5% |

|

2011 |

9203 |

55,6% |

59.7% |

92.6% |

|

2012 |

9905 |

7.6 % |

60.5 % |

93.7% |

While high oil revenue spending is not necessarily a problem, the dependency is. It is very difficult to cut spending once it has risen so far and so fast.

It is obvious from the evidence that there is overspending (relative to saving) and the current level of expenditure growth cannot be supported by actual or projected revenues. Considering the amount of petroleum remaining, slow growth in the non-oil non-government sector, and weak non-oil revenue generation, the aggressive budgetary expansion in Azerbaijan cannot be justified.

According to SOFAZ, the fund’s incomes from the Azeri-Chirag-Guneshli and Shahdeniz deposits will decrease from $13.1 billion in 2012 to $9.2 billion in 2024. Increased gas revenues will not cover the loss from oil revenues. This means that, barring new large-scale discoveries, the government will be hard-pressed to finance recurrent or capital expenditures unless tax revenue is raised from other sectors.

Azerbaijan has little historical experience in independently managing its oil industry and the revenues accumulated. Ideally, revenues from natural resources utilization would be spent on improving living standards and poverty eradication, which would lay foundation for sustainable economic growth. Although economic diversification has been declared the highest priority of the government and the often touts this concept, research done by Azerbaijan civil society experts shows the country still faces a number of problems and obstacles to ensuring income from non-oil sectors.

Learn more in the report Oil and Gas Revenue Management in Azerbaijan.

Fidan Bagirova is NRGI’s Eurasia senior officer.

Authors

Fidan Bagirova

Eurasia Senior Officer