Microsurvey: For Investors, Open, Competitive Licensing Most Important Governance Issue

Eighty percent of resource-rich countries fall short in channeling extractives wealth into citizen benefit, according to the 2013 Resource Governance Index (RGI),[1] which measures countries’ governance, including regulation, transparency and accountability across the resource sector.

Governments looking to attract investment, however, might not find reforms straightforward: investor attitudes toward governance may not always align with those of citizens.

Mandatory contract disclosures, which allow citizens to scrutinize the benefits from their countries’ natural resource endowments, may not appeal to investors who believe commercially sensitive information will be released.[2] Some investors might not welcome more open and competitive licensing, either, if they perceive that it adversely affects their business.

It is clearly in the interest of government officials to understand these possible tensions as they formulate policies for the sector. To help governments explore the relationship between investment and governance, I surveyed two groups. One group is made up of decisionmakers at oil, gas and mining exploration and production companies. Members of the second group, mostly investment bankers and consultants, advise extractive companies or assess their risk.

Below, I explain my survey and highlight key findings.

Survey

I asked participants from extractive companies how various policy changes would affect the likelihood of their company investing in a country. Most changes described increases in government transparency and accountability. There were also items on fiscal regimes for comparison.

Participants from advisory firms were given the same list of policy issues – these were framed as governance deficiencies. They were asked how each item affects their risk assessment of extractive projects or companies in that country.

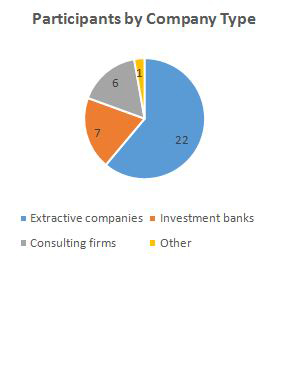

In total, there were 36 participants from 21 extractive companies, six investment banks and six consulting firms. Four extractive companies represented the mining sector; the other 17 were oil and gas.

The 22 participants from extractive companies work on investments across the globe. The most represented region was sub-Saharan Africa.

|

|

Key Findings

1. Transparency and accountability measures are generally viewed favorably by those making investment decisions

Four of eight policy changes describing increased government disclosures, and eight of nine describing more accountable licensing, regulation, and revenue management were perceived by over half of extractive company respondents to increase the likelihood of investment.

Only one respondent identified any policy change – stronger legislative oversight of licensing and stronger tax audits on companies – as discouraging investment.

Advisory firms also viewed lack of government transparency and accountability as a major risk. For over half the respondents, all but one governance deficit were perceived to increase risk of extractive projects or companies.

These results suggest that definitions of good governance in the resource sector from investors versus those representing citizens’ interests share significant common ground. Respondents explained that some governance components do not directly affect company financials, but pose potential reputational risks.

Top 5 Policy Issues for Extractive Companies

This table ranks issues by the percentage of respondents from extractive companies who indicated that reforms on the issue would “greatly increase” or “increase” their likelihood of investment (first column).

| Percentage of respondents who answered that ____ would “greatly increase” or “increase” ____ | ||

| Extractive companies a | Advisory firms b | |

| Transparent licensing rules and procedures | 100% | 86% |

| Competitive licensing rules and practices | 95% | 86% |

| Favorable fiscal regimes | 95% | 64% |

| Stable fiscal regimes | 94% | 93% |

| Clearly defined roles / powers of regulatory agencies | 89% | 92% |

|

a. Extractive companies were given a list of policy reforms and asked how each would affect likelihood of investment: “Greatly decrease likelihood,” “Decrease,” “No effect,” “Increase,” “Greatly increase,” “Don’t know.” b. Advisory firms were given a list of policy gaps and asked how each would affect risk assessment of extractive projects or companies: “Greatly decrease risk”, “Decrease,” “No effect,” ”Increase,” “Greatly increase,” “Don’t know.” |

||

2. Taxes matter and not just rates

More favorable fiscal regimes were perceived to offer a strong incentive for investment. Sixty-five percent of extractive company respondents said it would greatly increase likelihood of investment.

Many also stressed stability and clarity of fiscal regimes. Since extractive projects require high upfront investments, companies must have ongoing confidence in their estimates of costs and revenues.

Advisory firms said that they find unstable and unclear regimes to be even greater risks than unfavorable regimes. “Companies can make reasoned responses to tough fiscal terms…companies will find it impossible to mitigate against changeable terms,” a consulting firm director said.

It is clear countries must balance interests of citizens and investors when they set rates of government take. But reducing room for vested interests to change these rates would benefit both groups.

3. Investors want transparent, competitive licensing

Disclosures of licensing rules and procedures were deemed the most critical transparency issue. All extractive company respondents said more disclosures would increase likelihood of investment. Fifty-seven percent of advisory firm respondents indicated that non-transparent licensing greatly increases risk.

Because investors spend considerable time and resources preparing their bids, they want assurances that the process will be handled professionally and fairly. An Africa manager at an oil and gas company said well-documented licenses and licensing rules would reduce the need for due diligence and prevent scenarios of multiple claimants to the same title.

All but one respondent indicated more competitive licensing rules would increase likelihood of investment. Such consensus among companies of different sizes suggests there are no clear winners from corrupt or partisan licensing.

Conclusion

This microsurvey echoes findings of other qualitative studies[3] and quantitative studies[4] that quality of governance matters for investment.

It contributes new insights into the relative importance of components of resource governance. Investors strongly value stable fiscal regimes and open and competitive licensing. Transparency and accountability reforms that they value less do not seem to discourage investment.

Min Lee recently completed an internship with NRGI as a master’s student at Oxford’s Blavatnik School of Government.

Appendix

Table: Percentage of Respondents in Each Group That Answered “Greatly increase” or “Increase” for Each Policy Issue

| Extractive Companies | Advisory Firms | |||

| Greatly increase | Increase | Greatly increase | Increase | |

| Transparent resource reserves | 17% | 17% | 43% | 29% |

| Transparent resource exports | 11% | 17% | 29% | 36% |

| Transparent licensing rules and procedures | 33% | 67% | 57% | 29% |

| Transparent contracts with companies | 28% | 39% | 36% | 57% |

| Transparent payments from companies | 6% | 44% | 21% | 64% |

| Transparent environmental and social impact assessments | 22% | 50% | 29% | 71% |

| Transparent operational and financial information about SOEs | 6% | 39% | 29% | 57% |

| Transparent spending of resource revenues | 6% | 56% | 14% | 43% |

| Clearly defined roles / powers of regulatory agencies | 11% | 78% | 21% | 71% |

| Competitive licensing rules and practices | 28% | 67% | 43% | 43% |

| Legislative oversight of licensing | 17% | 56% | 21% | 71% |

| Due process for appealing licensing decisions | 22% | 50% | 14% | 57% |

| Professional, independent governance of SOEs | 22% | 44% | 7% | 71% |

| Audits on agencies receiving / remitting payments from companies | 6% | 50% | 7% | 36% |

| Tax audits on extractive companies | 6% | 22% | 0% | 50% |

| Accountable management / spending of resource revenues | 6% | 61% | 14% | 50% |

| Monitoring / enforcement of environmental, social standards | 6% | 56% | 14% | 50% |

| Clear fiscal terms in legislation | 39% | 44% | 64% | 29% |

| Stable fiscal regimes | 50% | 44% | 64% | 29% |

| Favorable fiscal regimes | 67% | 28% | 14% | 50% |

| Consistent, efficient tax administration | 39% | 50% | 14% | 71% |

[1] 47 of 58 countries examined were given ratings below satisfactory.

[2] NRGI has found that most information viewed as commercially sensitive is not contained in primary contracts: http://www.resourcegovernance.org/sites/default/files/RWI_Contracts_Confidential_Chapter_3.pdf

[3] See Fraser Institute’s Survey of Mining Companies and the World Bank Group’s World Investment and Political Risk Survey for examples.

[4] Cust and Harding, 2015, Institutions and the location of oil exploration, http://www.oxcarre.ox.ac.uk/files/OxCarreRP2013127(2).pdf