Big Sellers: Exploring the Scale and Risk of National Oil Company Sales

In many oil-producing countries, the national oil company (NOC) sells vast quantities of the state’s oil and gas. The sale of a state’s non-renewable natural resource endowment is often a revenue stream that can have a significant impact on a country’s national budget and the state’s ability to fulfil its national development priorities. It is important therefore that citizens are able to assess the performance of their NOCs, who they sell state assets to, under what terms they sell them and what they do with the resulting sales revenue.

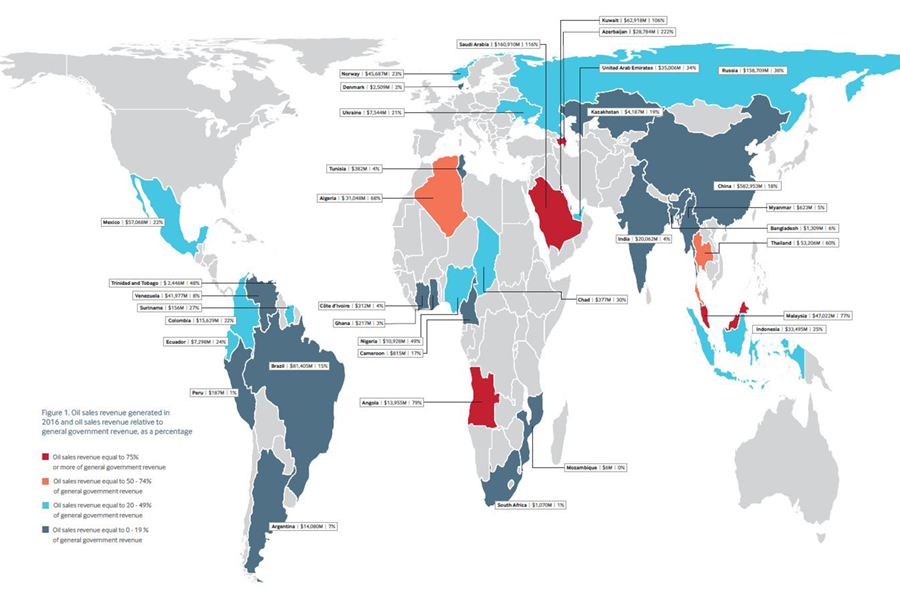

In this briefing the authors use data from NRGI’s new National Oil Company database to examine the governance and corruption risks posed by NOC’s oil sales activities. Using this newly compiled data including over $1.5 trillion in oil sales from 39 NOCs in 35 countries, they found that:

- The sale of oil is an economically significant activity for many countries. The oil, gas and product sales of 35 countries’ national oil companies (NOCs) to commodity traders and other buyers generated over $1.5 trillion in 2016, equaling 22 percent of these countries’ total government revenues.

- Most NOCs only pass on a small percentage of their oil sales revenue to government treasuries. NOCs from the 30 countries for which data are available transferred just 22 percent of their revenue to the country’s national treasury.

- This results in NOCs managing huge public revenues in environments that lack basic transparency, accountability and good governance practices. Seventy-nine percent of the identifiable oil sales, or $1.2 trillion, occurred in countries with “weak” or “poor” scores in the 2017 Resource Governance Index.

- While oil sales disclosure has improved in countries which are part of the Extractive Industries Transparency Initiative (EITI), non-EITI countries generated over 90 percent of the identifiable NOC oil sales revenue, or $1.4 trillion.

This briefing also presents case studies from the Republic of Congo, Nigeria and Ecuador of ways oil sales data, where available, has been used to scrutinize NOCs’ commercial performance and to hold them accountable for the revenue generated when selling the state’s oil.

Greater transparency on oil sales would begin to mitigate risks related to the selection of buyers, negotiation of the terms of the sale and the transfer of revenues from the NOC to the state treasury. Given the need for greater transparency, the briefing concludes with the following recommendations:

- Companies that buy oil and gas from NOCs should disclose these transactions on a sale-by-sale basis. Governments in commodity trading hubs, including Singapore, Switzerland, the United Arab Emirates, the United Kingdom and the United States should require these companies to disclose the payments they make to purchase oil and gas from governments and NOCs.

- All NOCs should commit to disclosing the buyers, volumes and prices of individual sales of oil and gas.